Crypto indicators on Telegram are actionable suggestions advising merchants to purchase or promote a selected cryptocurrency. For newbie merchants or these missing time to investigate charts, indicators simplify decision-making, these cryptocurrency indicators can save time, allow you to make knowledgeable buying and selling choices, and cut back the probabilities of shedding capital as a result of a foul name.

Most crypto indicators suppliers use Telegram to share crypto indicators with their group due to how briskly messages are delivered and the way straightforward it’s to comply with updates. You get alerts in actual time and an in depth evaluation supporting every suggestion.

On this article, we are going to cowl what crypto indicators are intimately, how crypto indicators work, the favored sorts of cryptocurrency buying and selling indicators, and the advantages and dangers of crypto indicators on Telegram. Moreover, you’ll discover ways to learn crypto buying and selling indicators and the way to decide on a crypto indicators Telegram group to comply with.

What Are Crypto Alerts on Telegram?

The crypto indicators on Telegram are buying and selling directions that recommend when to purchase or promote a cryptocurrency. Every sign consists of clear entry and exit factors or costs, which comprise a cease loss to handle danger and a take-profit goal to safe good points. Telegram crypto sign teams typically advise promoting a proportion of the place primarily based on market situations.

For instance, a sign for ONDO/USDT in futures buying and selling may predict a major value enhance. You enter a brief place at $0.055 (5,500 ONDO at 1x leverage, as an example). When ONDO rises by a sure proportion, say 40%, the supplier will advise you to take revenue on 50% of the place and maintain the remaining 50% in anticipation of a better rise that reaches the preliminary take-profit goal you set.

This strategy helps you lock in partial earnings whereas nonetheless leaving room for probably bigger good points if the commerce hits the preset take-profit margin. This danger administration technique protects merchants from market volatility.

Cryptocurrency indicators depend on market knowledge, reminiscent of value charts, quantity, technical indicators, and social media sentiment. Utilizing this knowledge, skilled analysts share predictions to information merchants in making the most of risky markets.

For the sign teams, suppliers often provide free and paid companies. Many paid crypto sign teams provide free indicators, with premium customers receiving enhanced insights and steerage. Telegram is a typical platform for delivering these crypto buying and selling indicators due to its real-time message supply, quick notifications, and robust crypto communities.

How Do Crypto Buying and selling Alerts Work?

Crypto buying and selling indicators work by giving a full plan for coming into and exiting a commerce. This plan tells you when to purchase or promote, the place to take revenue, and when to shut the commerce if the worth goes within the fallacious path. The purpose is to take away guesswork and assist merchants clarify choices primarily based on evaluation.

To get these buying and selling indicators, skilled merchants analyze these knowledge to create actionable indicators, together with value charts, quantity, technical indicators (RSI, MACD, Bollinger Bands), sentiment from social media and information, and on-chain knowledge. With this evaluation, they make predictions and advocate them to their crypto inside circle or sign group. Every crypto buying and selling sign sometimes consists of three important components, that are listed under:

1.Entry Value: That is the worth vary the place the commerce ought to start. It’s the level the place the crypto sign suppliers count on the market to maneuver within the predicted path. Now, say the entry value of a commerce is 0.0950, and you bought the sign a couple of minutes later when the market value has moved a bit, you possibly can nonetheless open your place on the present market value and set the parameters shared within the indicators group.

2. Cease Loss: Cease loss is a value that limits how a lot you possibly can lose if the commerce fails. If the worth drops or rises too far in the wrong way, the commerce closes robotically at this level. This protects your account and prevents one commerce from inflicting vital monetary loss.

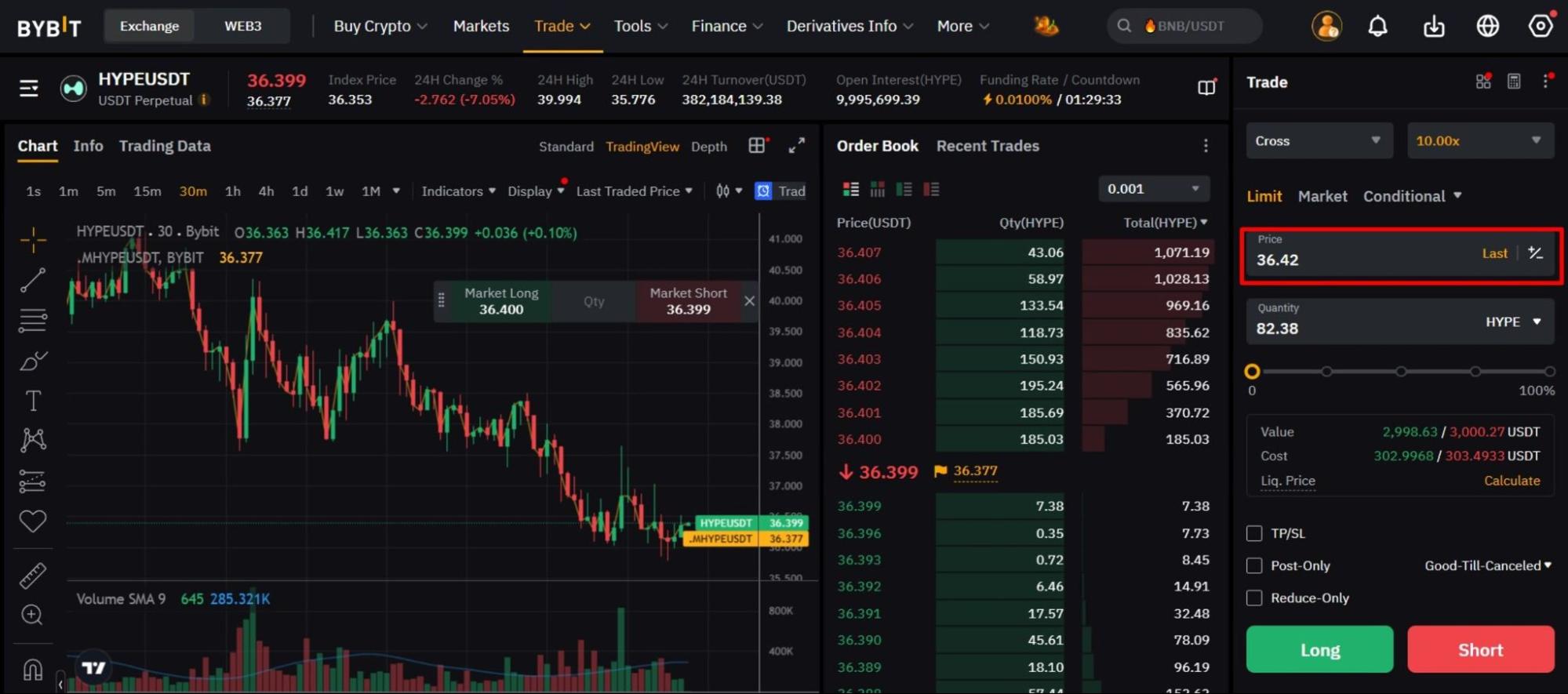

Relying on the crypto alternate you’re utilizing to commerce, yow will discover this device on the backside nook of the buying and selling interface, which is often depicted as TP/SL (Take Revenue/Cease Loss).

3. Take Revenue: Take revenue is the worth at which you shut the commerce with a achieve. Some buying and selling indicators give one goal, whereas others give two or three targets. Merchants can shut the commerce absolutely at one stage or take a part of the revenue at every stage (that is the place promoting in components or percentages is available in). This technique reduces danger and secures good points incrementally.

These three buying and selling instruments work collectively to kind detailed indicators that merchants can comply with and probably make earnings. Your Telegram crypto sign teams present all the small print for guide indicators. All it’s important to do is enter these particulars to execute trades shortly with out spending hours watching charts.

Why Telegram for Crypto Alerts?

Skilled merchants and technical analysts use Telegram for crypto indicators as a result of messages are delivered quick. The second a sign is distributed, everybody within the group sees it in real-time. That is necessary in buying and selling as a result of crypto market volatility, the place a delay of even one minute can have an effect on the results of a commerce.

Past real-time supply, Telegram fosters dealer connections via group options. Most crypto sign teams have massive group chats and broadcast channels, making it straightforward to prepare communities round particular buying and selling methods or digital property. Customers may comply with updates, ask questions, and work together with others whereas getting actionable suggestions from skilled merchants.

What are the Common Sorts of Cryptocurrency Buying and selling Alerts?

The favored sorts of cryptocurrency buying and selling indicators are crypto futures indicators, day buying and selling indicators, and purchase and promote indicators.

Crypto Futures Alerts

Crypto futures indicators are made for merchants who cope with contracts as a substitute of shopping for cash instantly. Right here, merchants predict the token’s future value actions with out proudly owning the property. A crypto futures sign tells you when to enter the commerce, what path to take, the place to exit, and the way a lot leverage to make use of. It additionally features a cease loss, which protects your account if the commerce goes fallacious.

Here’s what a typical crypto futures sign appears to be like like:

Crypto Day Buying and selling Alerts

Day buying and selling indicators are used for brief trades the place merchants have to act quick to capitalize on market actions. The concept of this buying and selling model includes opening and shutting trades inside 24 hours. Just like the futures buying and selling sign, the crypto day buying and selling sign additionally consists of detailed sign data just like the cryptocurrency to commerce, entry value, stop-loss stage to restrict losses, and take-profit targets.

Crypto Purchase and Promote Alerts

Purchase and promote indicators are for spot buying and selling. That is whenever you purchase a coin, maintain it, and promote it when the worth goes up. When following spot buying and selling indicators, traders instantly personal the underlying crypto property, in contrast to futures buying and selling, the place contracts are used. Spot crypto indicators specify the motion (purchase or promote), the actual coin to commerce (e.g., BTC, ETH), entry value zones, stop-loss ranges to restrict draw back danger, and take-profit targets.

Spot buying and selling indicators assist merchants capitalize on short-term value swings, compound good points over time, and keep away from funding charges or expiry dates related to leveraged merchandise. With out leverage, spot buying and selling avoids liquidation dangers, making it safer for cautious merchants.

What are the Advantages and Dangers of Crypto Alerts on Telegram

The advantages of crypto indicators on Telegram for newbies and superior merchants are real-time alerts, comfort and time-saving, insights from extra skilled merchants, alternatives for studying, and emotion-free buying and selling. In the meantime, the dangers of crypto indicators on Telegram embody a scarcity of assured accuracy, over-reliance on sign teams, and pump-and-dump schemes.

Benefits of Utilizing Crypto Alerts

Under are some great benefits of utilizing crypto indicators:

Actual-Time Buying and selling Alerts: Crypto buying and selling sign suppliers provide traders well timed and dependable indicators, whereas Telegram delivers instantaneous notifications. This pace permits merchants to capitalize on market alternatives without having to observe charts always.Comfort and Time-saving: A high-quality crypto sign offers you a transparent plan with the entry and exit factors, cease loss, and revenue targets. You may place the commerce and go about your day whereas nonetheless staying concerned out there. Moreover, Telegram is mobile-friendly and straightforward to make use of, which makes following and reacting to commerce alerts easy and accessible.Insights From Extra Skilled Merchants: Some crypto sign suppliers are skilled merchants or analysts providing high-accuracy indicators primarily based on market insights, sentiments, and technical evaluation. Buying and selling indicators shared by merchants with expertise give newbies a head begin. It might probably additionally assist merchants who don’t have the time to conduct detailed market evaluation with their crypto buying and selling technique.Alternatives for Studying: After interacting with a number of crypto buying and selling indicators, sure value ranges and setups start to turn into recognizable. Over time, this helps you make higher choices by yourself since you perceive the pondering behind these strikes.Emotion-free Buying and selling: Buying and selling indicators cut back impulsive choices pushed by feelings like worry or greed. Crypto indicators restrict impulsive modifications, selling disciplined buying and selling..

Potential Dangers and Challenges of Utilizing Crypto Alerts

Under are the potential dangers and challenges of utilizing crypto indicators:

No Assured Accuracy: Anybody can open a crypto Telegram channel and begin sharing commerce concepts. That doesn’t imply they know what they’re doing. If the buying and selling indicators usually are not primarily based on robust market analysis, you possibly can lose cash quick. Even official analysts will be fallacious as a result of the crypto market is unpredictable, so there isn’t any assure of correct indicators or earnings.Over-reliance on Sign Teams: Merchants may rely solely on the crypto indicators suppliers as a substitute of doing their very own analysis and changing into extra conversant in technical evaluation to comfortably make modifications to the suggestions acquired. If all of your trades come from one particular person or crew, you’re inserting full belief of their judgment. In the event that they go fallacious, you go down with them.Market Manipulation (Pump-and-Dump Schemes): Some teams coordinate to artificially inflate the worth of a low-volume coin after which dump it as soon as others purchase in, leaving followers with losses. So, keep away from crypto indicators Telegram teams that promise enormous earnings or 100% assured wins.

Find out how to Learn Crypto Commerce Alerts on Telegram

Right here’s how one can learn crypto commerce indicators on Telegram like a professional.

Entry Value: That is the quantity that tells you when to open the commerce. Some crypto buying and selling indicators give one clear value. Others present a small vary, which implies the commerce will be entered wherever between two values. If the worth remains to be outdoors the vary, set a restrict order with the worth you need to purchase/promote at.Cease Loss: If the market strikes in the wrong way of the commerce, the cease loss is the place you shut the place and take the loss.Take Revenue: Alerts typically embody a number of revenue targets. Every goal is a value stage the place you possibly can shut half or the entire commerce. You may determine whether or not to take your full revenue on the first stage or maintain a part of the place for later targets.Course Tells You Whether or not to Purchase or Promote: If the sign says “lengthy order,” the dealer expects the worth to go up. If it says “quick order,” the purpose is to revenue from the worth drop of the crypto asset.Sign Sort: Some crypto buying and selling indicators are for spot buying and selling (shopping for and holding the precise coin), whereas others are for futures buying and selling (speculating on the longer term value of cryptocurrencies with out proudly owning the underlying asset).Leverage: If a sign consists of leverage, it is going to point out what number of instances to multiply your place. This implies you’re borrowing further funds to make the commerce bigger. Whereas leverage can enhance earnings, it additionally will increase danger.Screenshots or Chart Hyperlinks: Good crypto sign suppliers generally share a chart displaying the setup. This allows you to see the place the worth is, what sample is forming, and the place the targets sit on the chart.Observe-up Messages: After a sign is shared, the group may put up updates relying on market situations. These might embody messages like “transfer cease loss to entry” or “take partial revenue now.” Don’t ignore these updates. They information you because the commerce unfolds and assist you to handle it higher. At all times preserve alerts on if you happen to plan to behave on buying and selling indicators in actual time.

If you wish to discover extra about sign setups or how merchants use bots with Telegram alerts, this text on Telegram buying and selling bots will perceive how automated buying and selling instruments on Telegram work and the way you need to use them to execute trades instantly via the Telegram app.

Are All Crypto Alerts Dependable?

No, not all crypto indicators are dependable. One of the best Telegram crypto sign teams are backed by analysis and actual expertise, leading to about 90% correct indicators, however others are primarily based on guesses or copied from different teams. To get dependable buying and selling indicators, ask associates for suggestions. Whichever crypto buying and selling indicators group you select, make sure the platform has at the least a 90% success charge.

Find out how to Select a Crypto Alerts Telegram Group

To decide on a crypto indicators telegram group, you could first discover a dependable or respected crypto indicators supplier, take note of members’ interplay, after which select trades to comply with.

Examine the Sign High quality and How Usually They’re Up to date

Earlier than following a crypto indicators group, begin by becoming a member of the group and watching the way it works. Analysis on the Telegram channel to see if they’ve a monitor file of profitable or failed trades. Then, take a look at how the buying and selling indicators are shared. Examine if the crew shares frequent indicators and whether or not the messages include all the required particulars.

Along with frequent indicators, critical cryptocurrency sign service suppliers will give updates if the market modifications and can let you know when to shut early, take a proportion of your earnings, or shift your cease loss.

Supported Exchanges and Buying and selling Methods

Confirm if the group helps your most popular crypto alternate, reminiscent of Binance, BingX, KuCoin, and Bybit. Then, verify if the buying and selling model the group focuses on aligns with what you want. Keep in mind, the crypto buying and selling sorts to count on embody, however usually are not restricted to, day buying and selling, fundamental purchase and promote (spot buying and selling), and superior methods within the futures market.

Pricing (Paid Vs. Free Crypto Alerts Channels)

Many teams cost subscription charges starting from $30 to over $150 month-to-month, however some provide free trials, whereas others provide free buying and selling indicators for all times. Such sign teams assist newbies and merchants with tight budgets to experiment and earn revenue with out paying for crypto buying and selling indicators. Then again, paid teams provide unique indicators with increased accuracy, extra complete help, {and professional} insights, appropriate for high-volume merchants.

Popularity and Consumer Opinions

Analysis opinions on platforms like Trustpilot, Reddit, Telegram discussions, and academic assets. Search for and comply with established teams with a big, energetic consumer base and optimistic suggestions. place to begin your search can be our detailed compilation of the finest crypto indicators buying and selling Telegram teams to affix this yr.

Neighborhood Engagement and Help

Whether or not you’re contemplating paid or free buying and selling sign teams, select Telegram channels with energetic chats the place members talk about indicators, market developments, and buying and selling methods. As well as, responsive admins and extra help, like academic supplies, webinars, or personalised recommendation, are priceless.

Academic Content material

Some prime teams present academic assets alongside buying and selling indicators, serving to you perceive market evaluation and enhance your crypto buying and selling abilities. For example, Cryptoninjas provide academic assets, together with in-depth guides, exchanges and token opinions, and well timed information on market developments that can assist you sustain with happenings within the crypto world.

Along with the suggestions from the crypto indicators group, that you must do your individual analysis to grasp the crypto world and know which cash to commerce. That can assist you get began, take a look at this record of the finest low-cap cryptocurrencies to spend money on. With this, you possibly can know what cryptos have excessive development potential, what buying and selling indicators to take part in, and those to disregard.