Prime crypto analyst Benjamin Cowen is warning about Litecoin (LTC) after its halving occasion whereas updating his outlook on Bitcoin (BTC).

Cowen tells his 754,600 Twitter followers that the peer-to-peer funds community will possible decline in value after Wednesday’s halving occasion when miners’ rewards have been lower in half.

“As talked about a month in the past, LTC tends to peak in June/July of its halving yr after which fade into the halving. Following the halving, historical past reveals it’s best to mood your expectations on LTC till the post-halving yr (2025).”

In response to his chart, Litecoin traditionally rallies two months previous to a halving occasion then goes on a few year-long decline earlier than rallying within the subsequent yr.

Litecoin is buying and selling for $87.46 at time of writing, down 6.8% within the final 24 hours.

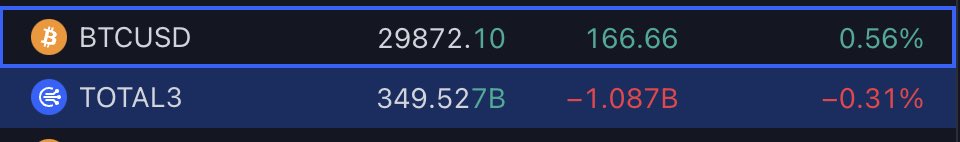

Taking a look at Bitcoin, Cowen believes that an outflow of altcoin market liquidity into BTC is sustaining Bitcoin’s rally as indicated by the declining complete market cap of altcoins (TOTAL3).

“BTC is up whereas altcoins are down. This goes together with the idea that the BTC rally is primarily fueled by the conversion of alts to BTC. Traditionally, within the pre-halving yr, we attain a turning level the place alt liquidity is not enough for BTC to proceed the rally.”

In response to Cowen, each the TOTAL3 market cap decline and a rise in Bitcoin’s dominance (BTC.D) assist his thesis.

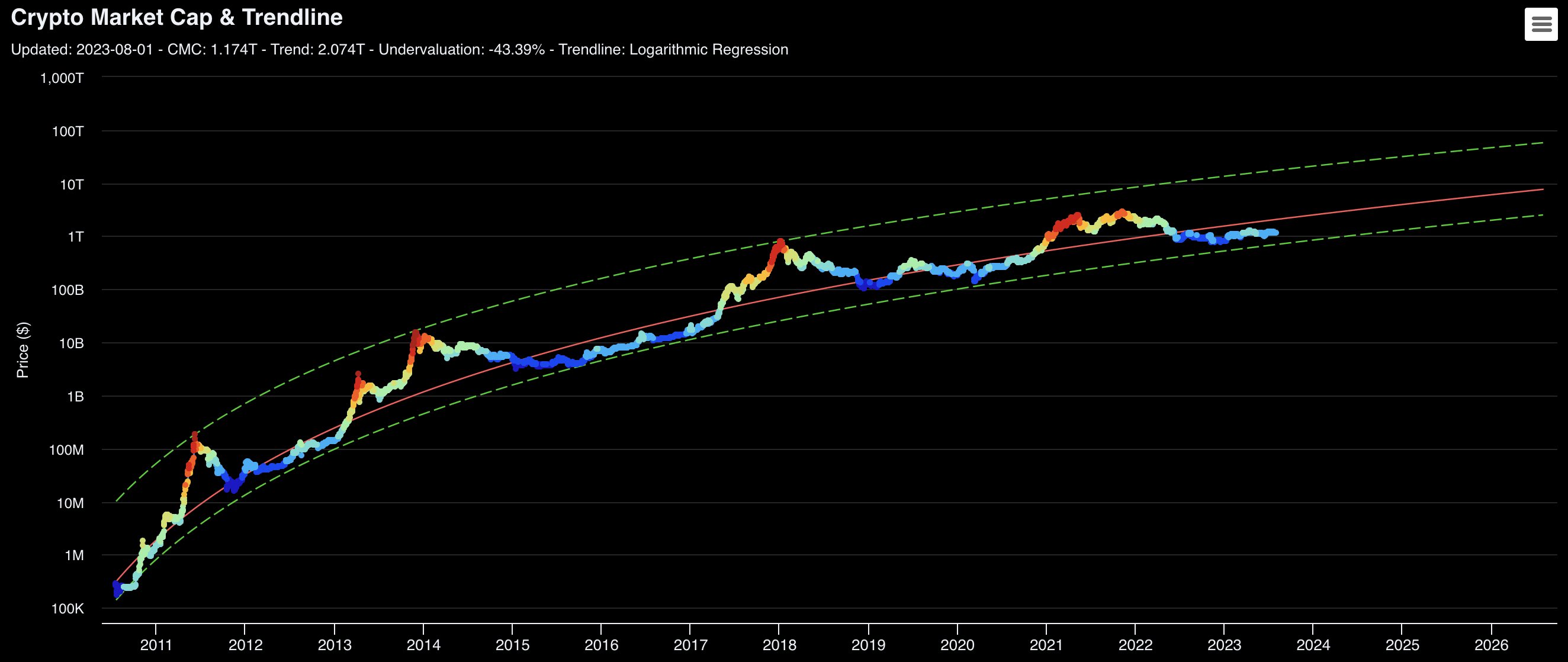

“Complete crypto market capitalization color-coded by BTC danger, which will depend on value, on-chain, and social metrics. Complete market cap has gone sideways for the final yr as a result of whereas BTC went up, most altcoins went down. Throughout that interval, BTC dominance went from 39% to 49%.”

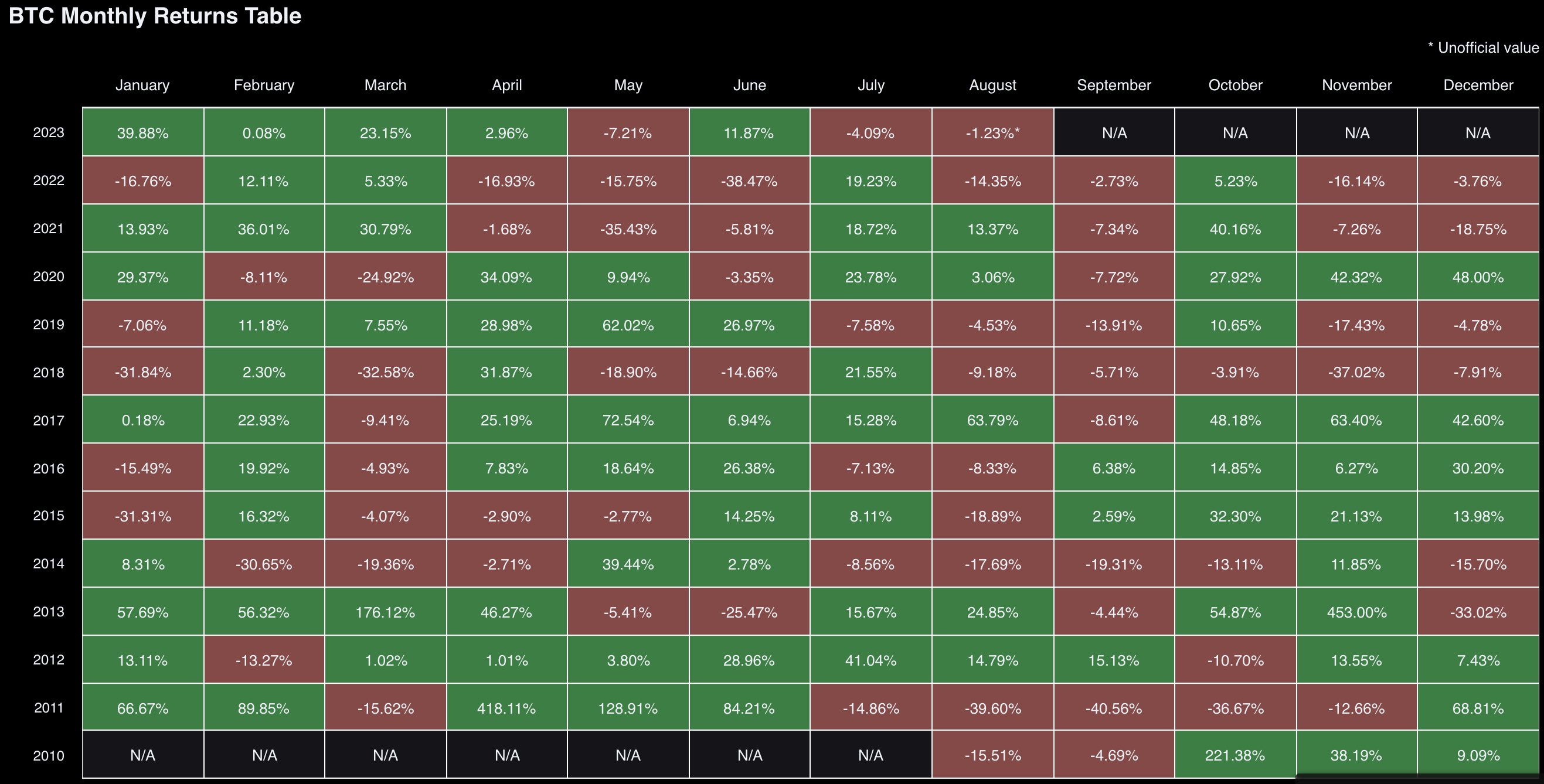

Cowen warns of a Bitcoin market correction based mostly on historic value motion throughout pre-halving years.

“Over the last three pre-halving years, Bitcoin fell beneath its bull market assist band in August/September…

No assure it occurs this time, however definitely a powerful chance.”

He notes an August Bitcoin dip can also be supported by the historic common return on funding (ROI) for pre-halving years, which in July matched fairly carefully to different Julys. If August performs out equally, Bitcoin may very well be an ROI of greater than -20%, in accordance with Cowen.

“As I beforehand talked about, the ROI of Bitcoin in July of the pre-halving years was -4.74%. The return of BTC in July 2023 ended up being -4.09%. FWIW (for what it’s value), the typical return of BTC in August of its pre-halving years is -21.3%.”

Bitcoin is buying and selling for $29,187 at time of writing, down 1.8% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Examine Newest Information Headlines

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney