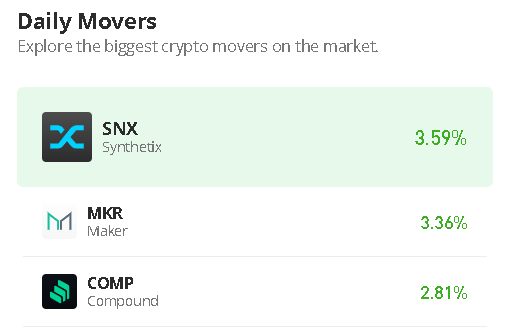

The founding father of Ethereum (ETH)-based decentralized finance (DeFi) protocol Synthetix (SNX) has introduced the launch of a brand new undertaking that he says goals to compete with centralized exchanges (CEXs).

In a brand new weblog submit, Kain Warwick explains why he desires to launch an trade when the Synthetix ecosystem already has Kwenta, a DEX that goals to supply zero-slippage buying and selling for crypto, foreign exchange or commodities artificial perpetual futures.

Synthetix has been utilizing Ethereum layer-2 Optimism (OP), however Warwick says that extra worth seize could possibly be achieved by constructing an trade that customers can entry without having to straight navigate via blockchain and DeFi.

“I’m certain you’re asking, ‘Why the f**okay do we want one other entrance finish, we have already got [Kwenta]?’ I consider it’s time to compete straight with CEXs. However which means making some compromises. The infrastructure is prepared. It’s time to transition to consumer acquisition mode.

Regardless of being dragged over damaged glass for years whereas ready for it, I nonetheless love Optimism. However Optimism remains to be an remoted island, far faraway from the [Ethereum] mainland. Not everybody is able to embark on a seven-day voyage to achieve this island, regardless of how gorgeous the seashores could also be. Will we await these lazy folks to return to their senses? I attempted that. It didn’t work out in addition to I’d hoped.”

The DeFi veteran proposes “Infinex”, the potential title for a Synthetix-powered centralized trade that customers can entry with merely a username, e-mail and password.

“The dealer indicators up with a username, password, and e-mail – that’s all that’s required.

Username and password you say?

To maximise the consumer expertise, Infinex generates a brand new public-private key pair for every consumer and shops it client-side within the browser. Nevertheless, this key can not withdraw funds. It’s solely used to signal trades despatched to the Account Relayer on Optimism…

When the dealer clicks deposit, a novel deposit tackle is generated for them. They will ship USDT, USDC, or sUSD to this accretion tackle. These funds are swept into the margin pool, managed through governance.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney