On Friday, Silicon Valley Financial institution, a 40-year-old establishment, collapsed, inflicting the FDIC to take over and put practically $175 billion in buyer deposits below the regulator’s management. The financial institution’s failure is the second-largest in US historical past and the biggest because the monetary disaster of 2008. The transfer evokes reminiscences of the worldwide monetary panic of a decade and a half in the past however didn’t instantly spark off fears of widespread destruction within the monetary trade or the worldwide economic system.

Shares of America’s banks noticed a big drop, with First Republic, PacWest Bancorp, Western Alliance Bancorp, and Signature Financial institution experiencing the biggest plunges amid rising contagion considerations following the biggest financial institution failure since 2008.

The looming Monetary Disaster

As we method the anniversary of the Nice Monetary Disaster, it’s regarding to see related warning indicators rising.

The US Treasury yield curve has just lately inverted to its deepest stage since 1981, whereas bankruptcies filings within the EU and US have hit a excessive not seen because the GFC. This, mixed with the diverging profitability between European and American banks, paints a bleak image for the monetary sector.

One of many key contributors to this potential disaster is the outdated accounting remedy for banks’ held-to-maturity (HTM) investments. Banks buy these securities to accumulate predictable money movement and meet liquidity necessities. Nevertheless, the present accounting remedy for HTM investments relies on their authentic value relatively than their present market worth. This creates a mismatch between the length of the HTM investments and the short-term nature of financial institution borrowing, leaving banks weak to losses on disposal if rates of interest rise or market circumstances change.

The COVID-19 pandemic has precipitated free credit score practices just like these resulting in the subprime mortgage disaster and the 2008 monetary disaster. Lehman Brothers additionally had the same situation with their HTM investments, in the end resulting in their collapse and the worldwide monetary disaster. Banks holding dangerous loans and property face substantial losses on disposal. The downfall of Lehman Brothers serves as a warning for banks to take well timed motion to mitigate threat and forestall bankruptcies.

The outdated accounting remedy of HTM investments have to be modified to keep away from the overvaluation of financial institution property and underestimation of threat publicity.

Silvergate and Silicon Valley Financial institution

That is exactly what occurred to Silvergate and Silicon Valley Financial institution, who skilled vital losses on their HTM investments and have been compelled to promote, contributing to their chapter. The weighted-average length of Silicon Valley Financial institution’s HTM securities portfolio was 6.2 years on December 31, 2022, in comparison with 4.1 years on December 31, 2021, indicating a length mismatch.

To forestall the same wave of bankruptcies, banks should act now to tighten credit score requirements and diversify their funding methods. Studying from historical past, we will see that an inverted yield curve and dangerous lending practices can result in monetary crises. Banks can mitigate dangers and allow well timed threat administration by updating their accounting remedy for funding methods.

The potential contagion of Silicon Valley Financial institution’s chapter to the tech and VC/PE trade is not only a hypothetical state of affairs — it’s a official risk. A catastrophic occasion like this is able to have cascading results on your entire market, in the end resulting in a widespread financial downturn.

The influence can be immense and long-lasting, as it will shake the very basis of the tech and VC/PE sector, which is the spine of innovation and development. The potential implications of this doomsday state of affairs are virtually too dire to ponder: thousands and thousands of jobs misplaced, numerous startups shut down, and a wave of investor panic resulting in a worldwide recession.

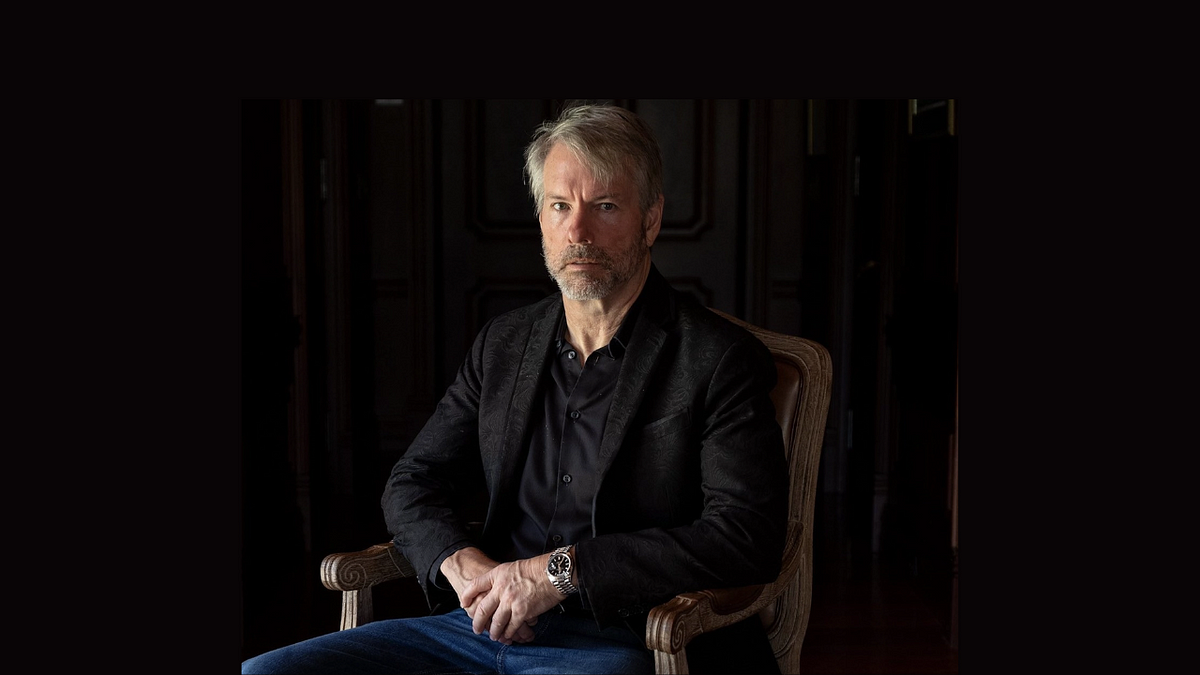

Patrick Mehrhoff is the Founder and CEO of MEHRHOFF DIGITAL, a number one Advertising and marketing Consultancy for Monetary Companies. He has a confirmed monitor file of success, having established advertising and marketing departments for Swiss FinTech startups, MoneyPark and Crypto Finance, that generated exit values exceeding 400 million and valuations over two billion. Patrick is a German nationwide, Licensed FinTech Skilled, and holds an MBA from the Energy Enterprise College.

In regards to the Firm

MEHRHOFF DIGITAL is the #1 trusted advertising and marketing consultancy for Monetary Companies, combining high-level technique and inventive creativeness with meticulous execution, fueled by a results-driven and intuitive genius, dependable information, success-based efficiency, and excellent conversational wit. We assist Monetary Companies acquire a aggressive edge, driving MRR, PQLs, and MQLs with meticulously crafted advertising and marketing options, merchandise, and companies.