Ripple CEO Brad Garlinghouse has acknowledged that the latest federal court docket ruling has confirmed that XRP is “not a safety”. The ruling gives the digital funds firm with better flexibility to pursue numerous enterprise alternatives throughout the globe.

Talking on Bloomberg TV, Garlinghouse expressed reduction that the corporate might now promote the varied use instances for Ripple and its expertise with out the concern of regulatory motion.

Ripple CEO Calls Out SEC For Anti-Crypto Stance

The ruling signifies a win for the crypto trade over the US Securities and Trade Fee (SEC), which sued Ripple in late 2020. The SEC accused the agency, co-founder Chris Larsen, and Garlinghouse of deceptive traders by promoting greater than $1 billion price of tokens with out registering them.

US District Choose Analisa Torres in New York dominated that the corporate’s $729 million gross sales of XRP tokens to classy traders met the check for an funding contract below federal securities regulation. Nonetheless, this didn’t apply to a whole bunch of tens of millions bought to the broader public by exchanges.

Garlinghouse referred to as the SEC “a bully” and celebrated the ruling as the primary time the company misplaced a crypto case. The company is anticipated to attraction the choice, however any appeals might take years. He additional claimed:

This can be a win for Ripple. It’s additionally a win for your entire crypto trade.

The ruling’s duality rests on the truth that retail patrons had no concept the place their cash was going or what it was getting used for in lots of situations, in distinction to classy establishments. The query stays whether or not this logic will acquire floor in different authorized battles or survive doable appeals.

One potential implication is that different cryptocurrencies deemed securities by the SEC might have the chance to problem that classification in court docket. If different cryptocurrencies can show that they aren’t securities and don’t match the authorized definition of funding contracts, it might open up new alternatives for innovation and development.

The Ripple ruling might additionally result in elevated scrutiny of different cryptocurrencies by the SEC and different regulatory our bodies. The SEC has already indicated that it’ll proceed to overview the choice and take applicable motion to guard traders.

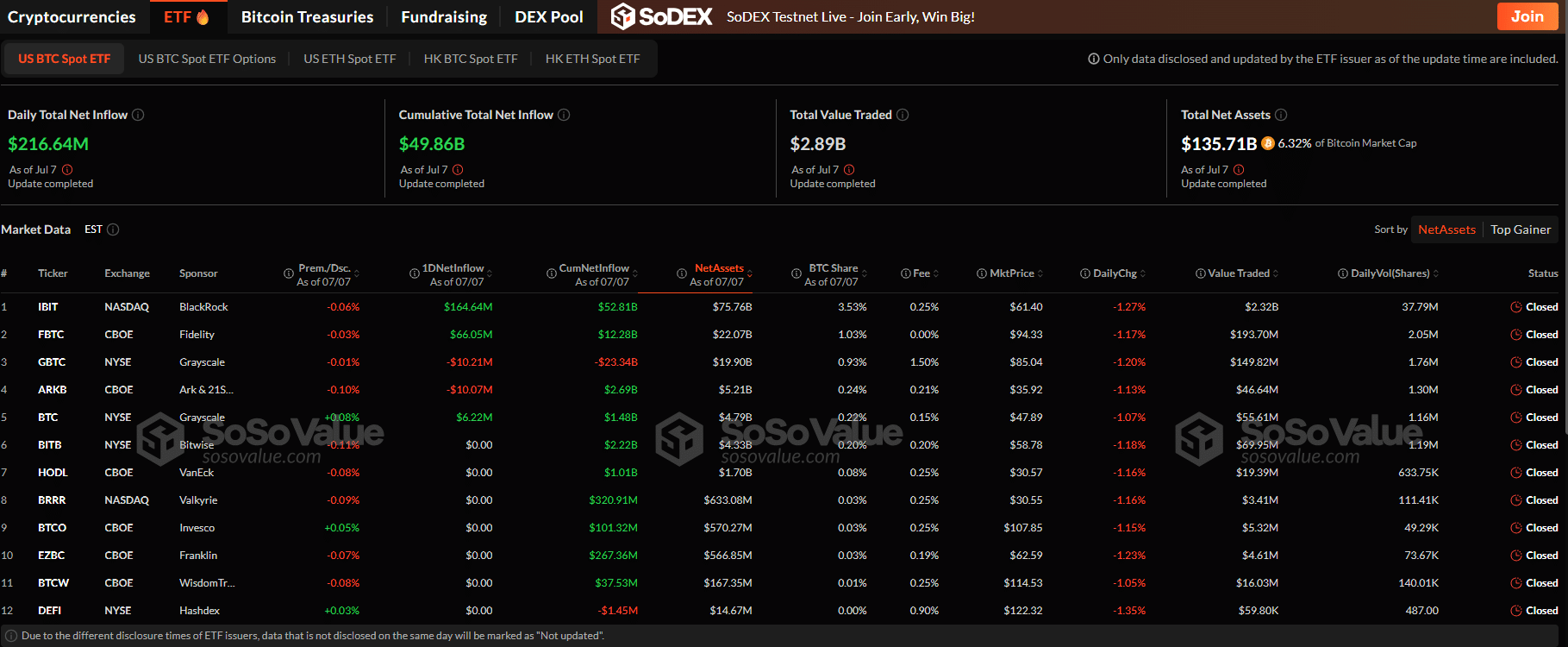

However, the ruling might additionally result in elevated adoption of cryptocurrencies by institutional traders, who’ve been hesitant to spend money on belongings which are deemed securities. With extra readability on the regulatory standing of cryptocurrencies, institutional traders could also be extra prepared to spend money on cryptocurrencies, resulting in elevated liquidity and market capitalization.

The SEC spokesperson Scott Schneider acknowledged that the company was “happy that the court docket discovered that XRP tokens had been supplied and bought by Ripple as funding contracts in violations of the securities legal guidelines.” The regulator was persevering with its overview of the choice.

General, the ruling has vital implications for the digital asset trade, offering better readability on the regulatory standing of cryptocurrencies and paving the way in which for additional innovation and adoption.

Featured picture from Twitter, chart from TradingView.com