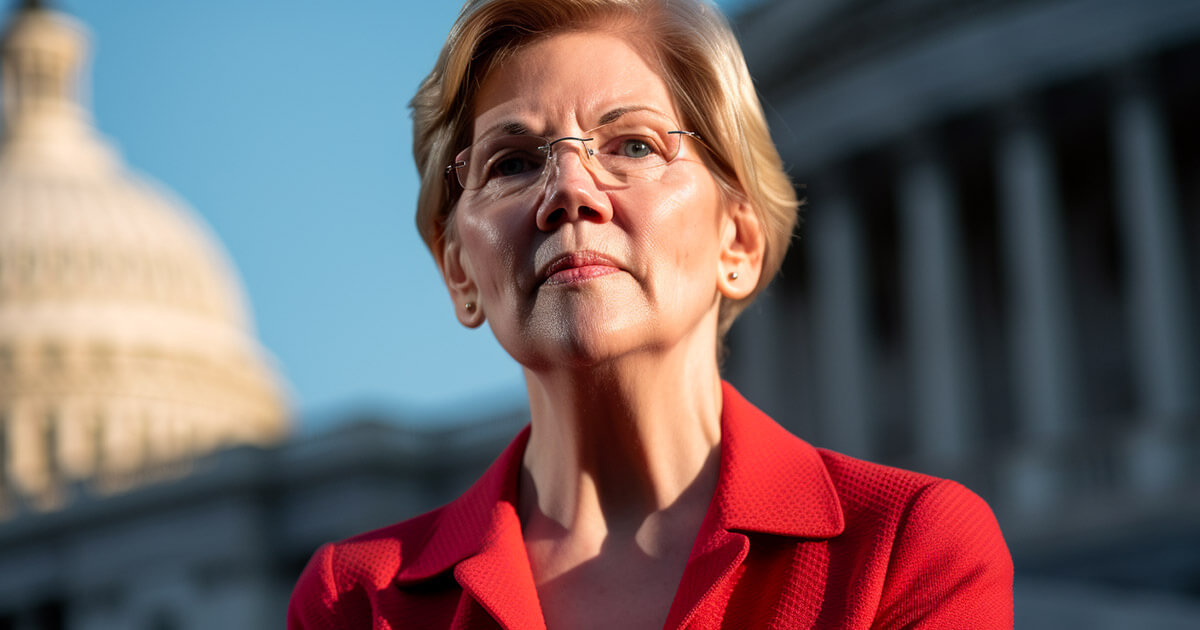

Meet Ulyana Shtybel, CEO of Quoroom: the end-to-end fundraising and cap desk administration software program supplier for personal corporations.

Based in 2018 and headquartered in London, Quoroom made its Finovate debut in March at FinovateEurope. On the convention, Shtybel demoed Quoroom’s investor relations instruments that assist corporations join with the fitting buyers, present a transparent visualization of the corporate’s monetary metrics, and maintain shareholders “within the loop” because the enterprise grows.

On this Q&A, we talked in regards to the present challenges personal corporations are going through with regards to securing funding. We additionally mentioned the enabling applied sciences and techniques which might be accessible to assist improve and speed up the method of elevating capital.

What downside does Quoroom clear up and who does it clear up it for?

Ulyana Shtybel: Capital elevating is damaged. Personal corporations spend months and even years within the fundraising course of, studying the best way to increase capital and repeating the identical errors, approaching the incorrect buyers and infrequently spamming them with irrelevant funding alternatives.

In in the present day’s world, startups need to develop into professionals in elevating capital, as they can not get funded in any other case. Nevertheless, hiring an expert adviser isn’t a standard observe, as they’re costly and there’s no applicable tradition to rent an funding banker till a enterprise turns into pre-IPO.

Whereas fundraising, corporations develop into distracted from their core enterprise actions and rely an excessive amount of on elevating capital. Buyers usually categorical their need for startups to focus extra on product improvement.

The fact is that there are a number of nuances and methods concerned within the fundraising course of. With out correct data and execution of those methods, startups and scaleups usually fail to lift capital. In line with a examine by CB Insights, 47% of startup failures in 2022 have been on account of a scarcity of financing.

With over 10 years of expertise in capital markets, finance, and enterprise capital, my staff and I made a decision to deal with this problem and rethink how fundraising is completed. We automated the fundraising workflow, knowledge visualization, and sharing of updates with buyers so corporations can simply do what is critical for profitable capital elevating: constructing relationships with buyers previous to the funding spherical and creating an investor’s FOMO (Worry of Lacking Out).

Quoroom additionally supplies an information room and investor portal to shut offers with buyers and a capitalization desk to handle shareholders and the administration of the corporate.

How does Quoroom clear up this downside higher than different corporations?

Shtybel: Quoroom is the primary data-centric capital elevating and firm administration software program. Corporations use Quoroom to construct relationships with buyers and lift capital as much as 4 occasions sooner whereas saving hundreds of {dollars} in software program and authorized charges yearly.

We’ve got a deep understanding of the capital elevating course of and what really drives buyers to spend money on startups. Not like different investor relations software program in the marketplace, we assist corporations ship investor updates and share knowledge with potential buyers, not simply current ones.

Quoroom combines all the mandatory instruments for elevating capital and managing buyers, that are at the moment fragmented, in a single place. It covers personal firm administration from funding to secondary liquidity in a single platform, saving corporations tons of time and money in the long run.

Who’re Quoroom’s main prospects? How do you attain them?

Shtybel: Our main viewers is personal corporations from the know-how sector, together with startups and scaleups. We attain out to them by our helpful content material, occasions, and our companions, comparable to legal professionals, company finance advisers, and different followers of our product.

Are you able to inform us a few favorite implementation or deployment of your know-how?

Shtybel: Quoroom isn’t solely a SaaS platform for corporations, however we additionally provide our know-how as a white label for funding banks and boutiques to supply nice worth to their purchasers.

Our know-how is simple to deploy, and thru funding corporations, much more corporations and buyers can expertise a seamless capital elevating course of.

What in your background gave you the arrogance to answer this problem?

Shtybel: As a former Government Director of the Warsaw Inventory Alternate Workplace in Ukraine, I had the chance to fulfill many know-how corporations that weren’t prepared for an IPO, however wished to lift capital to scale their companies. That is how I began working with startups and scaleups on the one hand and VC buyers on the opposite. Later, I co-founded my first tech enterprise and went by the fundraising course of, operating into most of the similar issues and errors, regardless of having a implausible community of buyers in my contacts.

My firsthand expertise in profitable and unsuccessful fundraising helped me establish patterns, and that is how Quoroom was born and launched in late 2020.

The personal capital market is but to develop and choices will develop into extra data-driven, I’m fairly assured Quoroom is an answer to assist conventional inventors and AI-driven VCs take higher choices.

What’s the fintech trade like in your space? What’s the relationship between emergent fintech startups and the nation’s established monetary companies sector?

Shtybel: Quoroom is legaltech and fintech software program that operates within the capital markets trade, which is predominantly represented by options for public capital markets, and a few options that service personal corporations. Nevertheless, these options are fragmented, and a median personal firm often invitations buyers to 5 completely different platforms and makes use of eight platforms to handle the identical funding, which could be a pricey and inconvenient method. One of the vital established gamers in our trade is Carta, which is U.S.-based cap desk administration software program. They don’t have the fundraising element, however they’re actively buying corporations within the sector. The U.S. enterprise capital and personal fairness market are a lot bigger than the European market – 60% versus 21% of world VC deal worth – however Carta acquired a European portion of the cap desk administration market by way of the acquisition of Capdesk. The 12 months 2022-2023 is displaying that the fintech market tends to consolidate.

You latterly demoed your know-how at FinovateEurope in London. What was that have like?

Shtybel: FinovateEurope was actually the most effective occasions I’ve ever attended. The format was very completely different from some other convention, as the complete viewers was there to take heed to startup demos. This was completely implausible and distinctive, as each company and buyers got here to take heed to the demos. After our demo, we obtained a lot consideration from buyers and potential companions.

What are your targets for Quoroom? What can we count on from the corporate over the steadiness of 2023 and past?

Shtybel: We rectify the capital elevating course of to assist extra corporations thrive. Our platform presents each capital and compliance options for corporations, in addition to knowledge, high-quality deal circulate, and exit infrastructure for buyers. We look ahead to working with corporations and companions from completely different international locations, so extra individuals can discover the worth of Quoroom.

Picture by Recal Media