Thanks to the EFers that supplied precious enter and suggestions to the draft doc: Bastian Aue, Vitalik Buterin, Bogdan Popa, Tomasz Stańczak, Fredrik Svantes, Yoav Weiss, Dankrad Feist, Tim Beiko, Nicolas Consigny, Nixo, Alex Stokes, Ladislaus, and Joseph Schweitzer.

Thanks to kpk, Steakhouse Monetary, and pcaversaccio for offering precious and insightful enter and the ultimate assessment of this doc.

The Ethereum Basis (EF) exists to strengthen Ethereum’s ecosystem and uphold its long-standing non-negotiable goals: enabling “functions that run precisely as programmed with none risk of downtime, censorship, fraud, or third-party interference”. EF Treasury helps EF’s long-term company, sustainability, and legitimacy. Capital deployments needs to be balanced between in search of returns above a benchmark fee and lengthening EF’s function as a steward of the Ethereum ecosystem, with a specific concentrate on DeFi.

This doc offers the insurance policies and steering for EF Treasury administration and discusses the important thing indicators and concerns.

1. Macro Coverage

To realize its goals, EF will keep and periodically refine an asset-liability administration coverage and a high-level grant allocation technique. EF will handle its belongings, contemplating threat, length, and liquidity, whereas remaining aligned with Ethereum’s core rules.

Our method focuses on two variables:

A: Annual Opex (expressed as % of present whole treasury)

B: Years of Opex Buffer (variety of years of working runway held in reserve)

The place:

A × B: determines goal fiat-denominated (offchain or onchain) reserves. This worth straight informs the dimensions and the cadence of ETH gross sales.(TotalTreasury – A × B) defines the worth of ETH reserves: dividing by ETH value provides the variety of ETH that can stay in core holdings.

At common intervals, the Board and Administration re-evaluate each variables, weighing market dynamics and neighborhood enter to maintain short-term operations aligned with long-term technique. Two additional lenses form every assessment: (1) figuring out pivotal years that benefit heightened ecosystem engagement and (2) sustaining a counter-cyclical posture—stepping up assist in downturns and moderating it in bull runs.

Present targets stand at A = 15% of treasury for annual opex and B = 2.5 years. This coverage displays our conviction that 2025-26 are more likely to be pivotal for Ethereum, warranting enhanced concentrate on important deliverables.

EF expects to stay a long-term steward, however envisions its scope regularly narrowing. We intend to cut back annual opex roughly linearly over the subsequent 5 years, ending at a long-term 5% baseline that’s widespread for endowment-based organizations. This glide path and baseline might be reviewed and adjusted as situations evolve.

2. Crypto Property Coverage

The EF will search to earn acceptable returns on treasury belongings in a fashion in step with Ethereum’s underlying rules.

The important thing concerns of the on-chain portfolio embrace, however usually are not restricted to:

Security and safety: favor battle-tested, immutable, audited, permissionless protocols. Encourage positive-sum actors within the Ethereum DeFi ecosystem. Purpose to counterbalance, and never contribute to, systemic dangers to Ethereum as an entire. Frequently re-evaluate initiatives for assault vectors and dangers, together with however not restricted to: sensible contract, governance, custodial (e.g., stablecoins), and oracle dangers.Affordable return and threat: choose conservative selections with greater levels of liquidity as an alternative of chasing solely excessive returns. Guard towards not simply the danger of lack of funds but additionally dangers to liquidity and common portfolio flexibility. Deployments which are considerably greater threat could occur however might be of a extra restricted scale and in segregated sleeves. In all circumstances, goal to be a modest portion of any single mission’s whole TVL.

Ethereum’s deeper targets: assist maximally safe, decentralized, open supply, cypherpunk functions. Cypherpunk DeFi is permissionless: no barbed-wire fences. Very best protocols are trust-minimized, composable, and maximally privacy-friendly.

We are going to often reallocate funds between protocols for causes equivalent to altering market situations, diversification, or new yield alternatives. Withdrawals needs to be understood on this context and never as anti-endorsements.

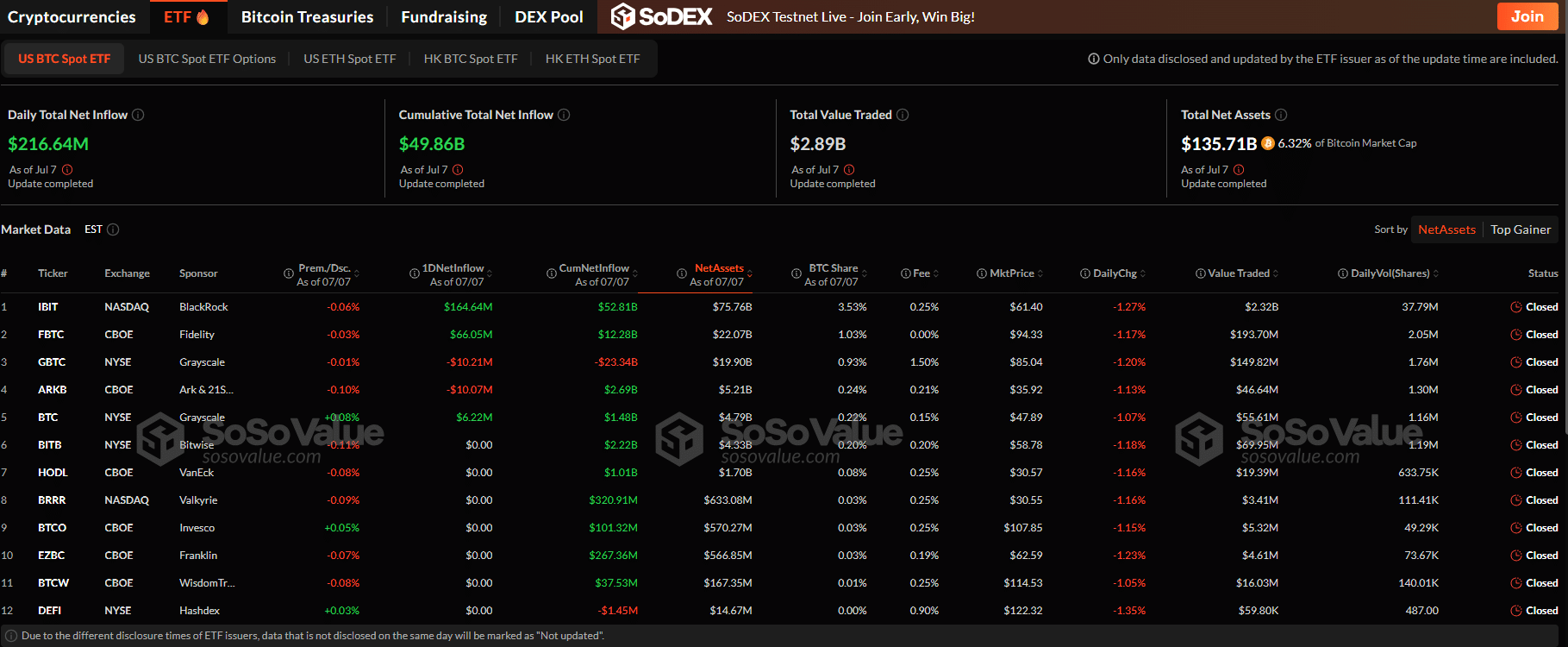

2.1 Ether Gross sales

All year long, EF will periodically calculate the deviation of the treasury’s fiat-denominated belongings from the Opex Buffer (“B”) goal and decide how a lot, if any, Ether might be offered over the subsequent three months. These gross sales will sometimes be through fiat off-ramps or onchain swaps for fiat-denominated belongings.

2.2 Ether Deployments

Our present methods embrace solo staking and wETH equipped to established lending protocols. Core deployments are re-evaluated regularly however meant to be long-term. EF may borrow stablecoins and search greater yields onchain. EF Administration and advisors will vet candidate protocols for contract safety, liquidity threat and de-peg threat, and different components. Because the DeFi ecosystem matures, EF plans to fold choose on-chain allocations, together with to fastidiously vetted farms and tokenized RWAs, into its fiat reserve.

3. Fiat-denominated Property Coverage

The EF will allocate its fiat holdings throughout:

Quick-liquidity belongings: money and different extremely liquid fiat-denominated devices that cowl real-time operational wants;Legal responsibility-matched reserves: fixed-term deposits, investment-grade bonds, and different low-risk devices aligned with longer-term obligations; andTokenized RWAs: ruled by the identical strategic goals and threat tips as native crypto belongings.

4. Transparency Coverage

The EF Co-EDs are accountable to the Board for the administration of the treasury.

To make sure transparency, accountability, and knowledgeable oversight, a structured inner reporting cadence is in place. Experiences are ready and maintained by the Finance staff, with distribution based mostly on scope and sensitivity.

4.1. Quarterly Experiences

The Finance staff offers quarterly reviews to the Board and Administration, together with:

Efficiency (Absolute and towards Benchmarks)All positions (Open & Closed because the final report)A abstract of notable occasions, together with:

Operations (processes, infrastructure, safety updates/incidents)Ecosystem engagement (conferences taken, partnerships, and so on.)

4.2. Annual Experiences

The annual EF Report will embrace additional treasury-related data, together with a abstract of main treasury allocations. For instance, percentages in fiat, idle ETH, and deployed ETH.

5. Cypherpunk Objectives

The EF (via its analysis, advocacy, and capital deployments) will construct on cypherpunk rules to assist formalize and apply a sensible analysis framework we seek advice from as “Defipunk” which has the next properties:

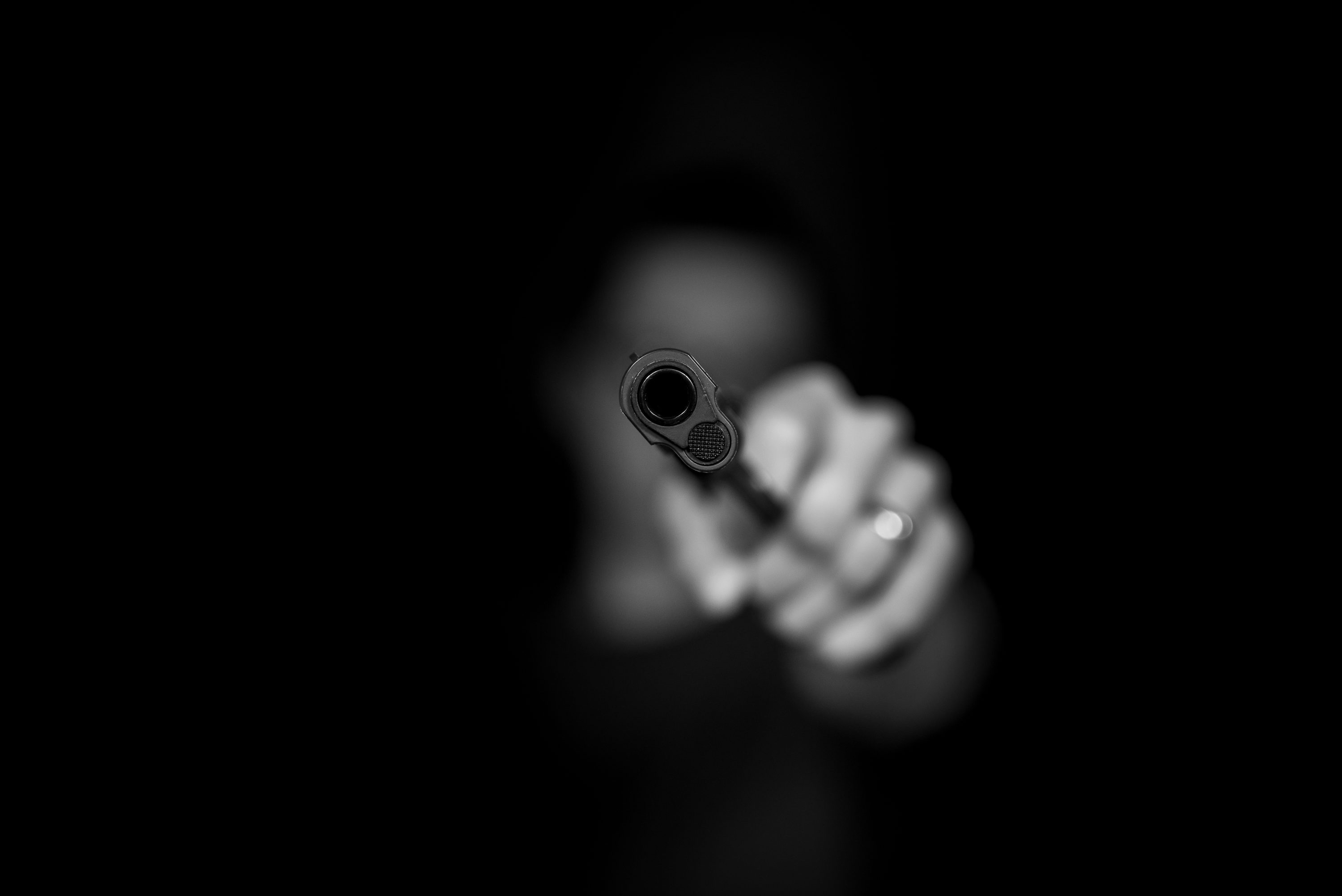

Privateness is traditionally uncared for within the broader DeFi area, nevertheless it stays important. Privateness protects market contributors from each digital surveillance (e.g., entrance operating, sandwiching, liquidation sniping, focused phishing, profiling and data-based coercion) and bodily threats (i.e. in-person coercion).

5.1. EF ought to actively assist initiatives of their Defipunk journey

Ethereum is poised to draw exponentially bigger flows of capital, expertise, and progressive power. Progress, nevertheless, is commonly path-dependent: requirements adopted in durations of chaotic speedy development harden into legacy constraints, and designs that privilege transparency can lock in surveillance by default. Incumbent methods usually exert refined pressures that slender the design area for novel DeFi primitives and constrain privacy-focused innovation. The Ethereum Basis will defend towards these pressures.

Via analysis, advocacy, and strategic capital deployments, the EF may help domesticate an Ethereum-native monetary ecosystem that safeguards self-sovereignty and sustains, at scale, “an open society within the digital age.”

Turning this imaginative and prescient into actual infrastructure takes work. There are quite a few challenges to constructing cypherpunk DeFi protocols immediately: greater fuel costs for privateness, UX friction, problem bootstrapping liquidity, extra stringent audit wants related to technical complexity and immutability, and, merely put, opponents to privateness. In consequence, a lot of immediately’s DeFi ecosystem depends on centralized parts: backdoor shutdown mechanisms or funds extraction features, extreme reliance on multisigs or MPC, pervasive use of whitelists, centralized and surveilled UIs, and a common absence of onchain privateness – all go away each DeFi markets and contributors uncovered to systemic vulnerabilities.

Privateness is especially necessary to get proper. As A Cypherpunk’s Manifesto factors out, “for privateness to be widespread it have to be a part of a social contract”. Privateness has inherent community results, and but it has obtained little or no consideration up to now. This implies that robust, early institutional assist from an EF-like entity will be uniquely precious in flipping the equilibrium towards a extra privacy-focused DeFi panorama.

EF is well-positioned to assist information DeFi’s evolution towards these targets. For instance:

Supporting nascent DeFi protocol to develop privateness featuresEncouraging mature protocols to strengthen Defipunk properties with analysis collaborations, liquidity, legitimacy, and different resourcesPromoting analysis and growth of decentralized UIs

A extra full listing of standards for mission assist will be present in §5.3.

5.2. Defipunk begins at residence

Advocating for open supply, privateness and different Defipunk targets extends far past EF, however embrace EF’s personal inner operations the place doable. Utilizing Defipunk rules within the EF’s personal treasury administration is a key first step on this regard. Extra typically, the EF can use secureware instruments, construct a prudent operational construction that’s supportive of all certified contributors, together with anon and pseudonymous contributors, and in any other case enhance its safety and privateness practices. This can assist the EF stay principled and develop in energy, stability, and the power to face agency.

Employees concerned in treasury administration ought to use and/or contribute to open-source, privacy-preserving instruments for routine duties, particularly if this requires upskilling in these areas. By taking care to reside and breathe Defipunk rules in its personal actions, EF will keep on course and achieve the capabilities to assist the remainder of the ecosystem in doing the identical.

5.3. Defipunk Standards

These are concrete standards for inner analysis of protocols and UIs, meant to encourage new initiatives to begin, and present initiatives to enhance. They may apply to all of EF’s future onchain deployments. Whereas some standards (e.g., permissionless entry, self-custody, and FLOSS) are simple binary determinants for deployment, others are extra complicated. For now, initiatives usually are not required to take a seat on the “perfect” finish of each axis. We search for credible progress and a roadmap for enchancment, moderately than perfection on day one. We share the framework overtly to supply legibility for EF choices and construct alignment on these axes, and in order that the broader neighborhood can contemplate, adapt, or apply them when forming its personal views.

Permissionless entry

Can anybody work together with the core sensible contracts with out KYC or whitelisting?

Self Custody

Does the protocol permit customers to take care of self-custody and current it as default?

Free-Libre & Open Supply (FLOSS)

Is the contract code free-libre open-source, with both a copyleft license (e.g., AGPL) or a permissive license (e.g., MIT, Apache)? Supply-available (e.g., BSL) does NOT qualify.

Privateness

Transactions: Does it supply choices for shielding tx origins/locations/quantities?State: Is consumer/private knowledge and/or place data shielded onchain?Knowledge: Does the protocol (and its typical UIs) keep away from pointless assortment of consumer knowledge (e.g., user-agent) and private knowledge (e.g., IP addresses)?

Open Improvement Processes

Is the event course of fairly clear?Are code repositories publicly accessible and actively maintained?Are protocol adjustments documented with clear rationales and versioning historical past?Is there visibility into the decision-making course of for upgrades, parameters, and roadmaps?

Maximally Trustless Core Logic

Immutability: is the elemental logic of the protocol non-upgradeable or ruled by a extremely decentralized, time-locked, and clear course of? (Keep away from admin keys with broad powers.)Maximal viable cryptoeconomics: does the protocol rely maximally on cryptographic ensures & financial incentives, and scale back using authorized wrappers (like collateralization assurances) or offchain enforcement to the naked minimal required for its core operate?Oracle reliance

Does it decrease reliance on oracles, and decrease losses in circumstances the place the oracle is compromised?Does it use sturdy, decentralized, governance-minimized and manipulation-resistant oracles wherever oracles are needed?

Normal Safety

Are the contracts audited, and processes in place to trace the audited commit hash towards what was final deployed, ideally together with monitoring/alerting when the diff adjustments?Are contract properties formally verified or no less than bytecode-verified on block explorers?

Distributed UIs

Are there a number of unbiased UIs?Is the first UI open supply and hosted in a decentralized method?Can customers work together straight with contracts?

Enduring Stewardship

The EF is right here to remain for a very long time and desires a strong long-term treasury administration coverage. Now we have for a very long time merely held ETH, however are actually more and more transferring into staking and DeFi, each to reinforce monetary sustainability and to assist a key software class that’s delivering on the promise of permissionless safe entry to base civilizational infrastructure for tens of millions of individuals immediately. EF’s involvement in these areas is well-positioned to set precedents for instrument use that’s accountable and appropriate with its underlying targets. To do that, it can make investments closely in skilling up its personal competency over time.

When you have concepts that contribute to EF x DeFi, please fill out this way.