The success of alpha crypto Bitcoin within the second quarter of 2023 was essential for Block Inc. The funds startup, led by Twitter founder Jack Dorsey, reported excellent earnings, recording $5.5 billion in income general. Notably, a sizeable portion of the $2.4 billion got here from Bitcoin gross sales.

Evaluating this time to final 12 months’s determine, the income related to Bitcoin has elevated by an astounding 34%. Regardless of experiencing decrease Bitcoin costs all through the quarter, the acquire in Bitcoin income and gross revenue was primarily pushed by a rise within the quantity of BTC bought to shoppers.

Money App, Block’s consumer-facing product, has turn out to be essential in sustaining the enterprise’s excellent income development in recent times. This program not solely sped up monetary transactions but additionally basically modified the panorama of digital banking.

Money App’s Contribution To Block’s Income Development

The gross revenue numbers for Money App eloquently illustrate the impression it has had on Block’s monetary surroundings. The newest monetary interval noticed a huge effect on the appliance’s skill to generate a staggering gross revenue of about $970 million, which helped the corporate’s backside line.

This accomplishment highlighted a major 37% rise in efficiency 12 months over 12 months, demonstrating the app’s persevering with enchantment and capability to regulate to shifting market circumstances.

You will need to observe that the decline in Bitcoin pricing throughout that point interval is what induced Money App’s Bitcoin income to plummet by 25%. Nonetheless, Block Inc. subsidiaries Money App and Sq. outperformed Wall Avenue forecasts when it comes to general efficiency.

Bitcoin is presently buying and selling at $29k. Chart: TradingView.com

Block’s success within the cryptocurrency trade has probably been influenced by the corporate’s CEO, Jack Dorsey, who’s a widely known Bitcoin supporter and has careworn the significance of a stronger concentrate on Bitcoin.

Block’s Efficiency In Different Sectors

Block’s dedication to Bitcoin is demonstrated by numerous initiatives, such because the adoption of Bitcoin Lightning Community funds on Money App, which allows customers to conduct quicker and cheaper Bitcoin transactions. By itself stability sheet, the corporate additionally had 8,027 BTC that have been price $245 million on the finish of the quarter.

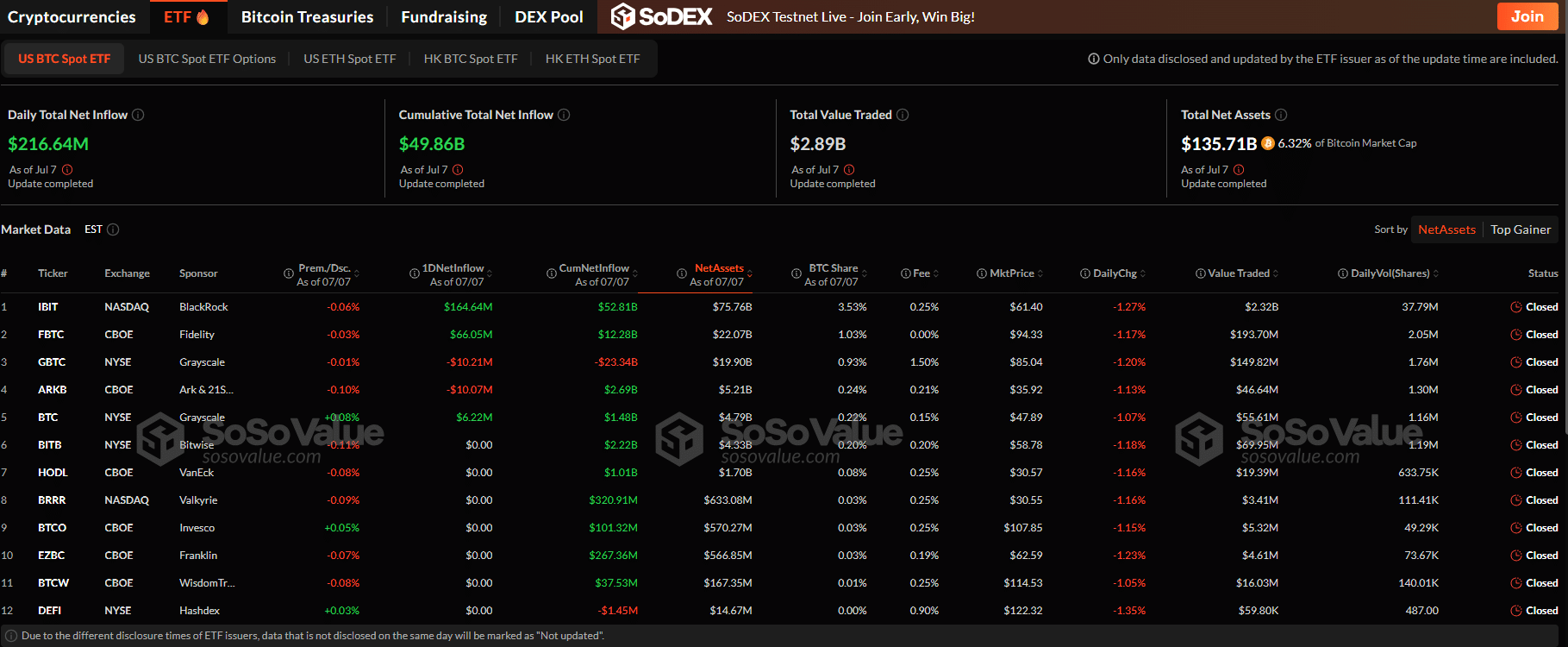

Record of corporations with substantial Bitcoin holdings. Supply: CoingGecko

Not Solely Bitcoin

Block continues to display power in different sectors, so the corporate’s success within the funds sector is just not fully depending on Bitcoin. Block’s banking merchandise confirmed great development, making $167 million in gross revenue, up 24% yearly, whereas Sq., one other essential division, produced a gross revenue of $888 million.

In the meantime, the corporate is now setting its sights on integrating generative synthetic intelligence (AI), growing globally, and offering omnichannel experiences.

Moreover, Block’s administration believes that there are big prospects for enlargement in markets exterior of the US, the place the corporate presently has lower than 1% of the market share.

Featured picture from TED