As Bitcoin mining agency, Core Scientific faces a big problem with the continuing chapter proceedings, it has taken a decided step in the direction of guaranteeing its sustainability. The corporate just lately submitted a Chapter 11 plan, a transfer that showcases its intentions to revamp its operations whereas satisfying the claims of its collectors.

The Chapter 11 plan was filed in the US chapter courtroom for the Southern District of Texas, Houston Division. Core Scientific, with this plan, has shared its imaginative and prescient of what the corporate would appear like post-bankruptcy, and its intention to construct as a lot consensus as doable with key stakeholders concerning the envisioned future.

An Optimistic Revival Technique

Core Scientific, regardless of its present chapter proceedings, has been upbeat about its monetary well being. Based on the corporate, it has witnessed a surge in liquidity since its Chapter 11 submitting.

They attribute this to a mix of upper Bitcoin costs, a surge within the community hash price, and decreased vitality prices. By specializing in restructuring its enterprise mannequin, Core Scientific believes it may well stage a profitable comeback, thereby offering a glimmer of hope in a difficult time.

Notably, Chapter 11 chapter which Core Scientific filed for offers a pathway for a company to keep up its operations whereas a restructuring plan is agreed upon by concerned stakeholders. Such a plan might embody methods like decreasing the scale of operations to reduce money owed or promoting off belongings to reimburse collectors.

At its core, the Chapter 11 chapter plan affords a blueprint that particulars how the corporate goals to restructure and fulfill its debt obligations.

Decision For Debtors In Possession (DIP)

Based on the submitted chapter plan, holders of allowed debtor-in-possession (DIP) claims will obtain full and ultimate satisfaction of their claims on the efficient date of the chapter plan. These stakeholders can anticipate both full money cost or an agreed-upon different.

Moreover, any liens granted to safe the DIP claims might be terminated, successfully eradicating the secured curiosity over the corporate’s belongings.

It’s price noting that the challenges confronted by Core Scientific spotlight the risky nature of the crypto-mining enterprise regardless of the revenue. Nevertheless, the corporate’s resilience, backed by a radical Chapter 11 plan, might nicely illuminate a path ahead for different crypto ventures navigating equally troubled waters.

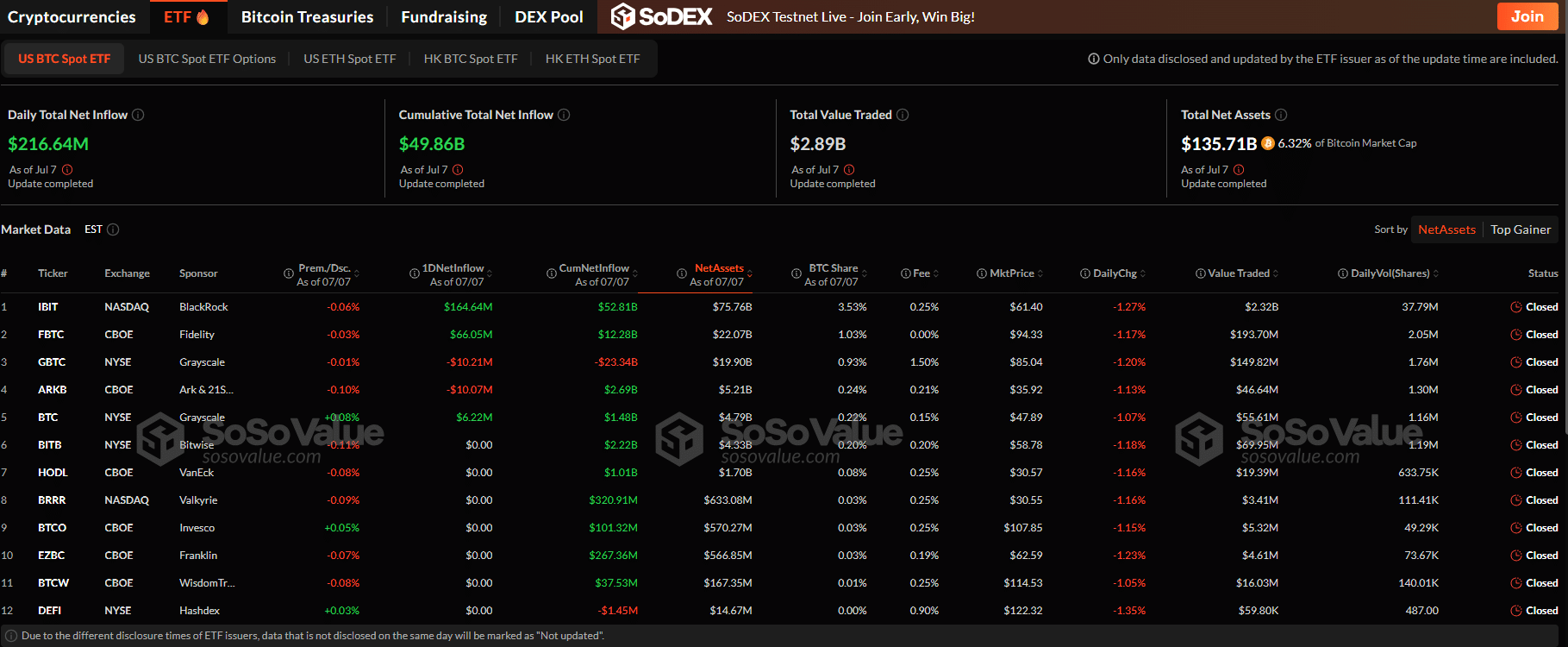

In the meantime, up to now week, Bitcoin has regained a few 1000’s of {dollars} misplaced amid the intensified scrutiny up to now few weeks. Over the previous 7 days, Bitcoin’s value has surged by greater than 10% from as little as $25,000 to as excessive as $28,924, on the time of writing.

The asset’s market capitalization has additionally spiked 11.6% over the identical interval with greater than $50 billion added. Bitcoin’s market cap at present stands at $561 billion, a surge from the $503 billion seen final Wednesday.

Bitcoin (BTC)’s value transferring sideways on the 4-hour chart. Supply: BTC/USD on TradingView.comFeatured picture from Unsplash, Chart from TradingView