The article under is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin Market Dynamics

The objective of this text is to zoom out and spotlight a few of the newest bitcoin market strikes by way of the lens of on-chain knowledge: realized worth, profit-taking conduct and bitcoin provide ranges.

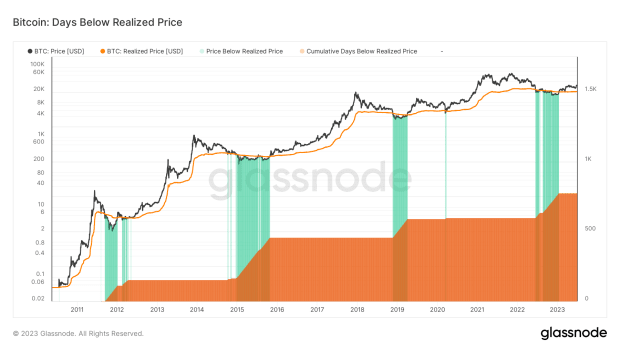

At the moment, bitcoin is buying and selling at roughly 1.5x its realized worth, which not too long ago resurged previous the $20,000 mark. This milestone offers an attention-grabbing perspective and different on-chain knowledge helps us paint a extra complete image. Following typical bitcoin capitulation occasions, the provision usually will get constrained by the members with probably the most conviction. We now discover ourselves exactly in such a part: A mere 13% of circulating provide is held on exchanges and within the palms of short-term holders.

Nonetheless, it’s essential to notice that whereas present worth motion and realized earnings don’t essentially help the notion of a full-fledged bull market, we to date have witnessed earlier realized losses/on-chain capitulation turning right into a small but regular stream of earnings (outdated cash transferring at the next worth degree than they had been acquired for).

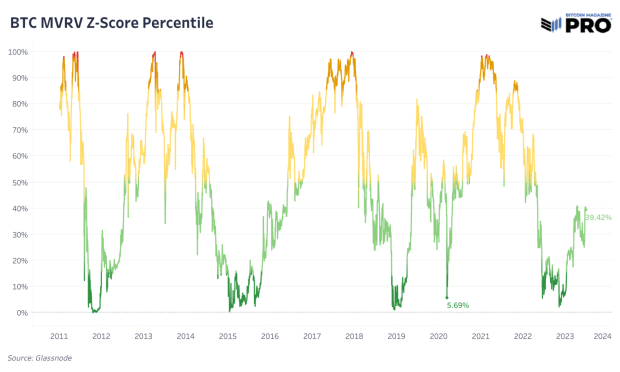

As proven under, the market-value-to-realized-value metric paints an image of the delivery of a nascent new bull market, with valuations now not at bottom-barrel ranges however nonetheless removed from comparatively overpriced, at present rating within the 39% of historic readings.

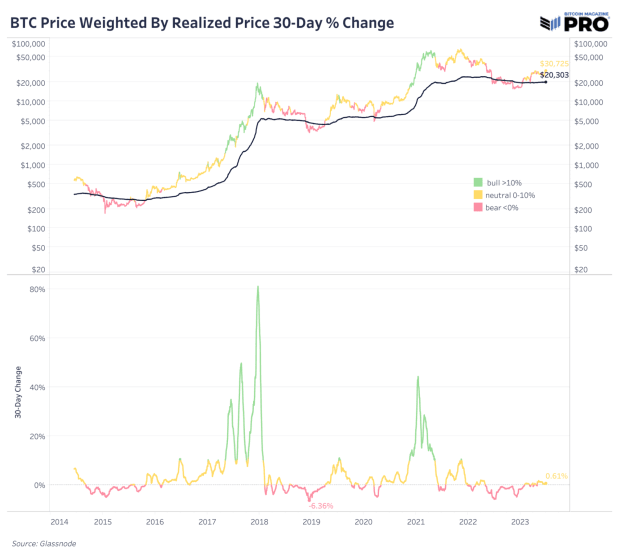

Trying on the charge of change of the realized worth, the historic analog of the present market look to be the early months of 2016 and the summer time of 2019, the place worth had sufficiently rebounded off the lows, with many of the bleeding lastly over, because the market consolidated amid constrained provide situations and a rising community impact of actual world adoption.

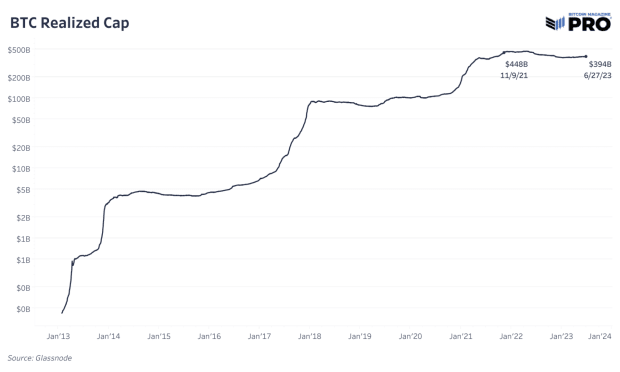

Realized Cap, Not Market Cap

The logarithmic chart of bitcoin’s realized market capitalization, reflecting the mixture worth of all bitcoin at their final traded worth, demonstrates the asset’s resilience. In contrast to market cap, which is the product of circulating provide and present worth, the realized cap reveals the exact worth of every bitcoin UTXO, courtesy of its clear ledger.

Realized cap paints a far completely different image relating to bitcoin’s monetization in comparison with what one could also be led to imagine when viewing bitcoin’s hyper-volatile mark-to-market change charge.

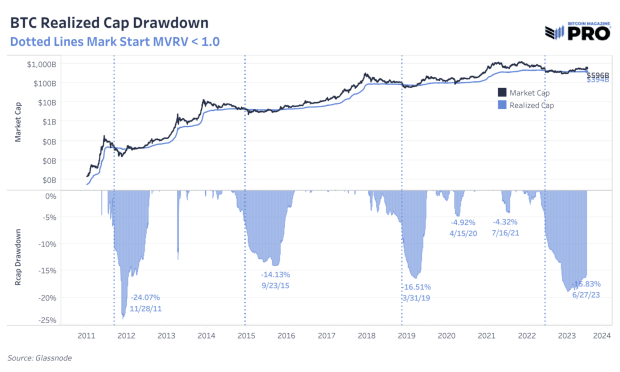

A mere 15% under the realized market cap all-time excessive, capital inflows have returned, resembling earlier bear market recoveries. Throughout restoration durations following bitcoin bear markets, we’ve got seen a reclaim of the earlier all-time excessive in realized market cap whereas bitcoin was nonetheless 40%-60% under its all-time excessive change charge. This historic dynamic demonstrates a pair issues:

First, it means that capital inflows can proceed to seep into bitcoin with out essentially triggering a raging bull market, as an alternative resulting in an surroundings of chop and consolidation. That is usually characterised by a tug-of-war between marginal patrons and sellers, the place worth ranges witness repeated assessments of resistance and help, all whereas accumulation from HODLers continues below the floor.

Second, it reveals a historic actuality the place bitcoin’s true valuation — the worth the place all its provide has traded palms — surpasses the all-time excessive lengthy earlier than the media frenzy and new wave of speculative inflows arrive once more. One can view this as an ode to the “sensible cash” traders, who don’t want the express sign of a nominal change charge all-time excessive to grasp that bitcoin’s fundamentals are stronger than ever.

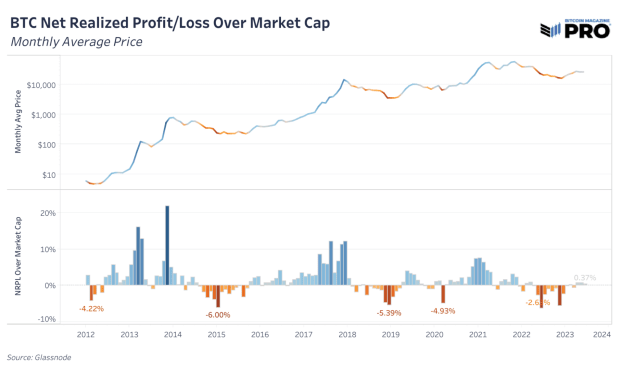

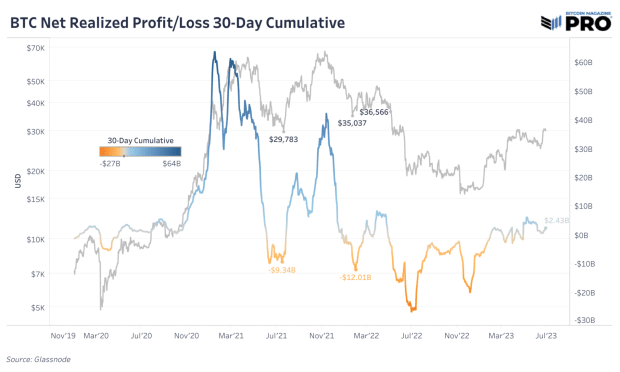

An indication of this dynamic is the web realized earnings relative to the bitcoin market cap. Following the worst of a bear market capitulation, bitcoin market inflows are distinctly constructive (however not but over zealous) whereas the change charge grinds increased to finally flirt with worth all-time highs.

As soon as the all-time excessive is damaged, inflows ramp up dramatically. The setup for this market cycle remains to be within the early phases.

Unrealized Revenue/Loss

We’ve examined realized revenue and loss cycles, so now let’s flip to the unrealized facet of the equation.

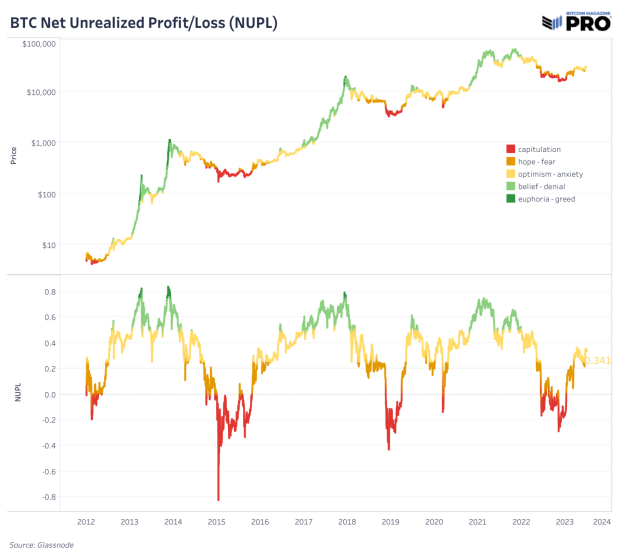

Relative Unrealized Revenue/Loss (NUPL) is an insightful metric designed to gauge investor sentiment within the bitcoin market by calculating the entire unrealized positive factors or losses throughout the present provide. To calculate the NUPL, subtract the realized cap (which represents the worth of every bitcoin when it final moved on the blockchain) from the market cap, then categorical this distinction as a ratio of the market cap. This metric works to standardize the state of the unrealized earnings/losses held by traders utilizing the market capitalization to account for an ever altering market valuation.

A better ratio sometimes suggests a state of greed or speculative froth amongst traders, indicative of potential market tops or overbuying situations. In distinction, a decrease ratio typically indicators an environment of worry or capitulation, doubtlessly pointing to market bottoms or overselling eventualities.

Within the present local weather, NUPL stands at 0.37, a degree we will categorize as optimism/anxiousness, relying on the development path.

It is noteworthy that the bitcoin market has by no means seen a restoration in NUPL from the capitulation part to the optimism part and not using a subsequent go to to 1 or each of the 2 highest tiers of NUPL: perception and euphoria.

Translated into easier phrases, this implies that bitcoin market recoveries, even from probably the most extreme situations, result in brighter days forward as a result of resilience of the bitcoin HODLer base and a constant switch of cash from weak palms to robust ones. The continued wealth switch underpins market recoveries, reinforcing bitcoin’s inherent power and setting the stage for additional development and potential worth appreciation throughout the subsequent interval of capital inflows.

Having simply recovered from the depths of the bear market in late 2022, the setup now mirrors historic market recoveries of previous cycles, as bitcoin as soon as once more climbs the wall of fear.

Free Float Constraints And UTXO Distribution

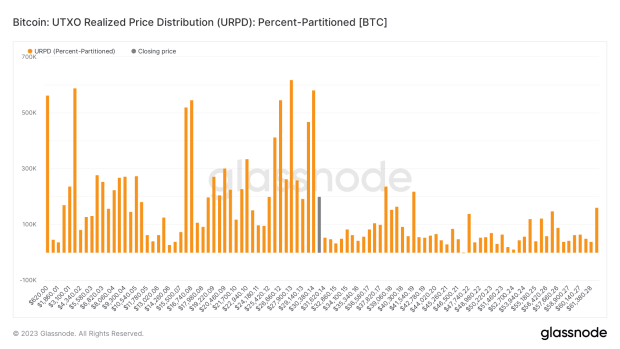

One other metric we will have a look at to indicate simply how sparse the figurative air is above the present buying and selling vary is the UTXO Realized Value Distribution (URPD).

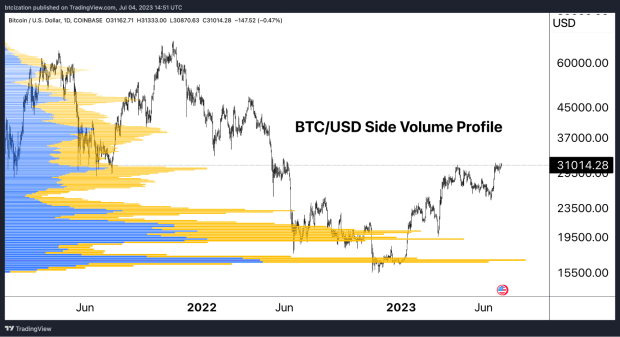

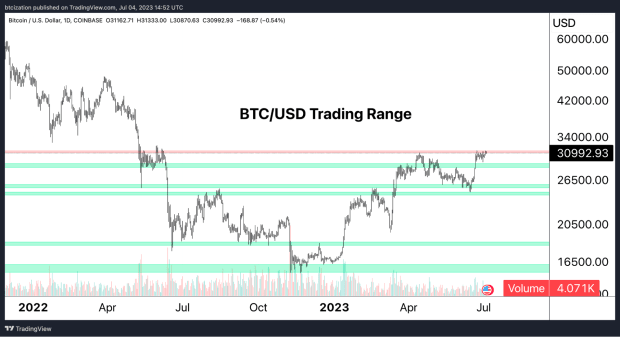

The URPD reveals that above $31,000, solely a restricted provide has exchanged palms, with nearly all of transactions occurring within the $15,000-$30,000 vary. The primary main resistance level from a provide distribution degree is round $40,000. This additionally aligns with the spot quantity buying and selling distribution, in addition to the technical breakdown of the chart.

With bitcoin trying to spring previous the degrees final visited across the time of the LUNA/UST-induced crypto contagion, demise of a number of exchanges and the business’s largest hedge fund, Three Arrows Capital, what can flip the bullish setup right into a actuality?

Capital inflows and a primed provide facet that’s constrained to historic ranges.

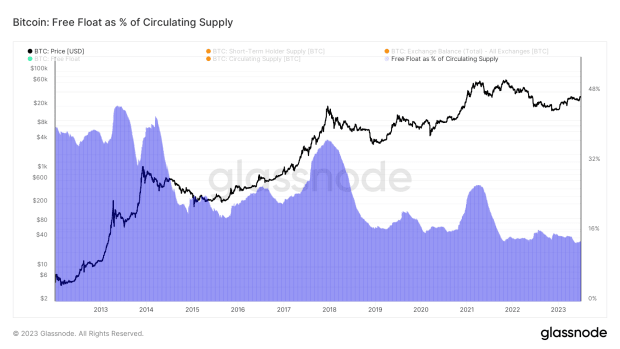

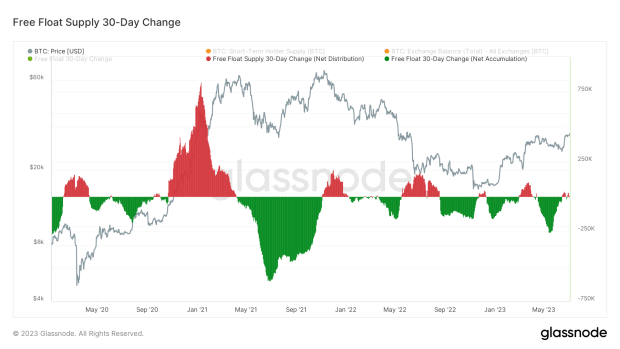

Trying on the free float provide of bitcoin, what we outline as exchanges’ balances along with short-term holder provide, the present setup factors to the tightest provide situations bitcoin has ever skilled.

Whereas it’s true that provide has been sufficiently constrained from a historic context since early 2022, we view the dynamic a bit otherwise at present, with the nascent bitcoin market having endured its largest capitulation interval ever.

Relatedly, we will see a gradual dose of accumulation occurring all through the course of the 2 years, with contagion occasions being the one issues to briefly reverse the development.

We anticipate the abundance of constructive information tales associated to bitcoin spot ETF filings to materialize in continued constructive inflows, with loads of opportunistic traders and speculators trying to entrance run the approval and launch of spot bitcoin ETFs by legacy establishments.

Whereas we anticipate that the approval of an ETF to return someplace within the late months of 2023 or early months of 2024, the cycle reset coupled with primed supply-side situations might result in continued constructive worth motion by way of 12 months’s finish.

In our view, macro correlations and market situations nonetheless maintain significance within the bitcoin market, however the idiosyncratic catalysts of a possible spot ETF approval and the halving arriving close to the identical time — plus charge cuts prone to arrive in 2024 — has us leaning bullish.

Within the short-term, bitcoin starting from wherever between $20,000-$40,000 wouldn’t be stunning with such an illiquid market.

Nonetheless, taking an extended view, the supply-side dynamics and potential for elevated demand flows is eerily much like the setups that led to earlier raging bull markets.

That concludes the excerpt from a latest version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles straight in your inbox.