What’s the “prime” for an immutable cash that turns into the usual for humanity? Why it’s time to get off zero.

That is an opinion editorial by Luke Broyles, a Bitcoin content material creator.

How a lot bitcoin does it take to get wealthy and fund your life-style? How little bitcoin does it take to guard your self towards inevitable inflation, financial institution runs and fiat demise? Are you “too late” to Bitcoin? What would a 1% allocation do?

These are questions that newbies and veterans of Bitcoin alike ask themselves and one another and, oftentimes, there isn’t a transparent reply.

Let’s present a stable framework to reply that query.

There Is No ‘Prime’ For An Immutable Cash Customary

January 2009 was BTC’s first worth prediction. Hal Finney predicted that bitcoin might turn into the global-dominant fee system, or $10 million per coin (Finney’s calculation can be nearer to $40 million at the moment). However bitcoin wouldn’t surpass $1.00 till April 2011… Over two full years later.

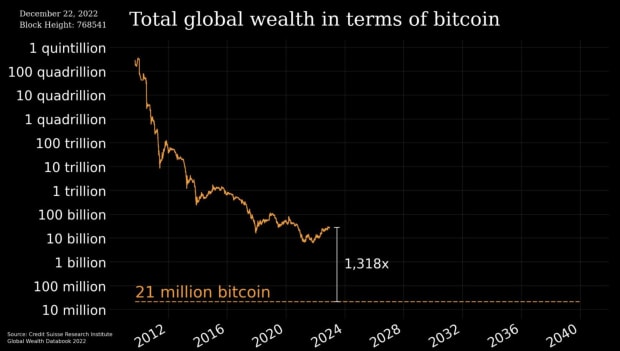

What Finney understood is that upon the invention of good cash all world wealth would inevitably consolidate into it. Henry Ford, Nikola Tesla and others additionally foresaw this.

A closed (financial) system inevitably absorbs all open (productiveness) programs. Cash is the know-how that costs every part else inside its personal ledger. There isn’t any “prime” worth prediction for an immutable financial normal of the human race, the usual.

It’s About Buying Energy, Not Value

So, a greater approach to think about bitcoin’s worth isn’t in worth, however in buying energy. Overlaying a share of financial inventory with a given quantity of productiveness (or financial worth) is a greater option to predict the cash’s worth. It’s price noting that in a finite ledger, wealth inequality as we all know it at the moment does the reverse as we count on at the moment (a subject for one more time).

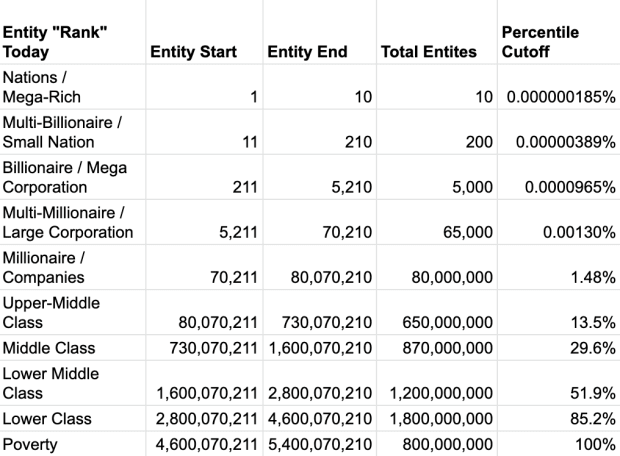

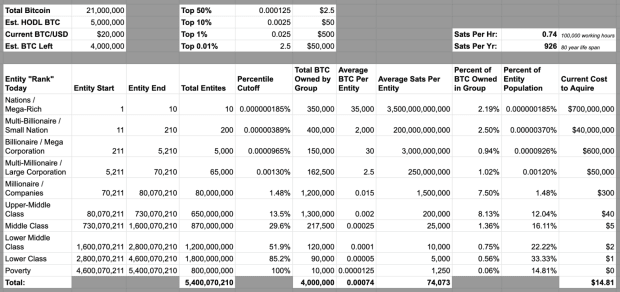

First, let’s make clear “entities.” We’ve 10 arbitrary “teams,” loosely based mostly on at the moment’s wide-ranging estimates of mega-rich entities to these in poverty.

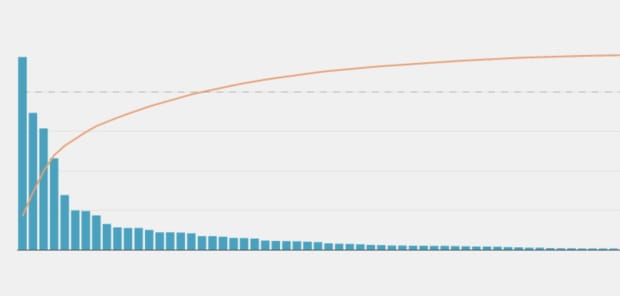

Second, we’ve to account for what is commonly attributed to the “Pareto precept”: The overwhelming majority of productiveness is created by the minority of individuals, and the overwhelming majority of that productiveness is created inside the minority of that minority.

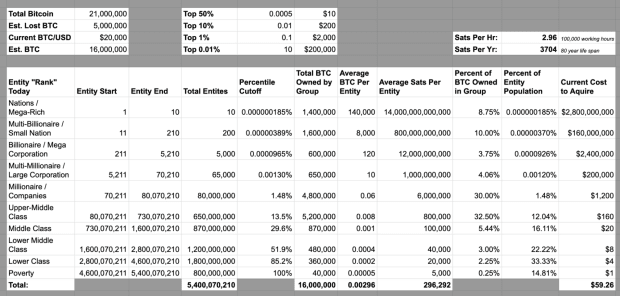

Third, we should account for the financial inventory to fill into our matrix. It’s usually mentioned there’ll “solely be 21 million bitcoin,” nonetheless this isn’t true. Accounting for misplaced bitcoin, there might simply be decrease than 16 million.

After we loosely observe a Pareto distribution and at the moment’s present ranked distribution of entities, the under is what we get. Fascinating outcomes. Michael Saylor, the U.S. authorities and some choose others have turn into Bitcoin’s 10 “mega wealthy” entities already.

Moreover, a mean particular person at the moment is extra affluent than a twentieth century billionaire was. Subsequently, if Bitcoin merely survives… as little as 800,000 sats might buy a way of life sooner or later way more luxurious than an upper-middle class life-style at the moment, since bitcoin is definitely reflecting the actual prosperity beneficial properties of the globe.

Let’s go additional. There are solely simply over two million bitcoin left on exchanges and just below two million left to be mined. Let’s take a hyper-bullish situation and assume there are solely 4 million BTC to be distributed, not 16 million. If we do the maths right here, issues solely get extra absurd.

On this situation, as little as $14.81, $100, or 75,000 sats (in the appropriate time horizon) might be actually life altering to an individual or firm of the longer term.

What if world wealth and prosperity will increase tenfold? What if the worldwide inhabitants will increase by two billion? What if one other two million bitcoin are misplaced? What if a nation-state begins secretly stacking, and one other three million bitcoin are held? What if a multi-billionaire tomorrow allocates 20% of their wealth to bitcoin, to soak up 100,000 BTC off the market? What if firms sooner or later make use of billions of AI bots to create productiveness to struggle over the remaining BTC? What if simply two of those situations happen?

What if in a couple of centuries vitality firms don’t burn coal or depend on fission, however mine asteroids, use fusion and start building of a Dyson swarm? Based mostly on our mannequin, what if these future firms have total stability sheets of 10 to 1,000 BTC? How does one worth that?

An entity promoting the rights to photo voltaic actual property or buying and selling a contract to an asteroid appears insane to us. Mock as we could, we’ve much less in frequent with the longer term than the previous.

Are You Too Late?

So, are you too late? Completely not.

A closed financial system is designed to by no means be too late for anybody, irrespective of how a lot or little productiveness they’ve. When people promote rights to the solar or different celestial our bodies within the photo voltaic system, it’s nearly sure to be bought in change for bitcoin. Cease pondering you might be “too late.” It is absurd.

The query is: What do you do with this data? Should you’re a USD millionaire in 2023, you don’t have any excuse to not purchase 0.06 BTC. At $20,000 per BTC, this 0.12% allocation might save your portfolio. If Bitcoin survives, ultimately this 0.12% will probably be extra useful than the opposite 99.88% of your portfolio. Even higher, allocate 1% for 0.5 BTC since inventory markets transfer 1% in a day. You should buy your “BTC insurance coverage” with only a day’s volatility.

Not a USD millionaire? You haven’t any excuse to not purchase $100 of bitcoin (0.005 BTC as of this writing) and lock it down… simply in case. You spend that a lot on insurance coverage on an unlikely occasion, why not spend it on a probable occasion? Most will not, as a result of understanding BTC is accepting many uncomfortable truths.You may quickly notice that allocating 1% places your different 99% at increased danger as you suck liquidity out of the fractional-reserve Ponzi.

The longer Bitcoin survives, the decrease its danger and the upper its upside. It’s designed to be a greater financial savings device as a operate of time. Personally, I believe my 16 million mannequin is simply too bearish and the 4 million mannequin is simply too bullish (for now).

Both approach, the highest-risk allocation to bitcoin is 0%. Both bitcoin is trending towards zero, or every part else is. There isn’t any third possibility.

Thanks, everybody, on your concepts. Maintain sharing that Bitcoin sign, and get off zero in case you are nonetheless on it.

This can be a visitor publish by Luke Broyles. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.