Key Takeaways

The Ethereum Shanghai improve is imminent, which means stakers will lastly be capable to unstake their ETH, a few of which has been locked up since 2021

17.7 million is ETH is staked, equal to 14.8% of your complete provide

That is just under the quantity of ETH on exchanges, which is eighteen.3 million ETH, equal to fifteen.2% of the provision

Value results of improve are doubtless already priced in, however this quantity of provide being launched is nonetheless notable

The Ethereum Shanghai improve is slated to happen in mid-April. Whereas not as seismic a shift because the Merge occasion which came about final September, it’s nonetheless an vital second for the world’s second-largest cryptocurrency.

Essentially the most impactful consequence might be round Ethereum stakers. For the primary time, these with staked ETH might be allowed to unstake their holdings.

How a lot Ethereum is staked?

And that’s lots of ETH. Presently, there’s 17.7 million Ether locked up in staking contracts, equal to 14.8% of the entire provide.

As soon as the improve goes dwell, this ETH will lastly be eligible to hit the market. That will sound like a scary proposition, however in actuality, there have been many liquid staking options out there all through the staking interval, which kicked off in late November.

In such a manner, stakers have acquired again liquid “tokens” which will be traded instead of ETH. These tokens can then be redeemed for precise ETH as soon as the improve goes dwell – which we now know is imminent.

Nonetheless, there could also be some elevated promoting stress within the rapid aftermath of the occasion. The liquid tokens have traded for (often small) reductions in comparison with ETH, whereas it would additionally now be extra intuitive and easier for folks to promote.

Regardless of all this, concluding that this can dent ETH’s value could be naive. The market is aware of that is coming and that very same outdated idea of “priced in” is acquire related. Bear in mind, many hypothesised that the Merge would drive an enormous value improve, however it got here and went with solely minor volatility.

If the Shanghai improve goes easily, it could not be a shock to see the identical occur right here.

Might the Ethereum staking yield be DeFi’s risk-free fee?

One factor I’ve puzzled about is what the yield on staked ETH will seem like going ahead.

One concept is that, if Ethereum continues to behave as the bottom layer for decentralised finance, the staking yield might seem like some type of risk-free yield within the house. In such a manner, it could possibly be used as a benchmark to worth investments within the house, very like the risk-free fee in conventional finance is used.

Then once more, with the best way DeFi has gone during the last couple of years, perhaps it gained’t. The house has seen a flood of capital flee the house because the bear market has ravaged cryptocurrency as a complete.

The place is the remainder of ETH held?

With 15% of the ETH provide locked up in staking contracts, and the quantity steadily rising from when staking opened up in late 2020, the stability on exchanges has finished the alternative.

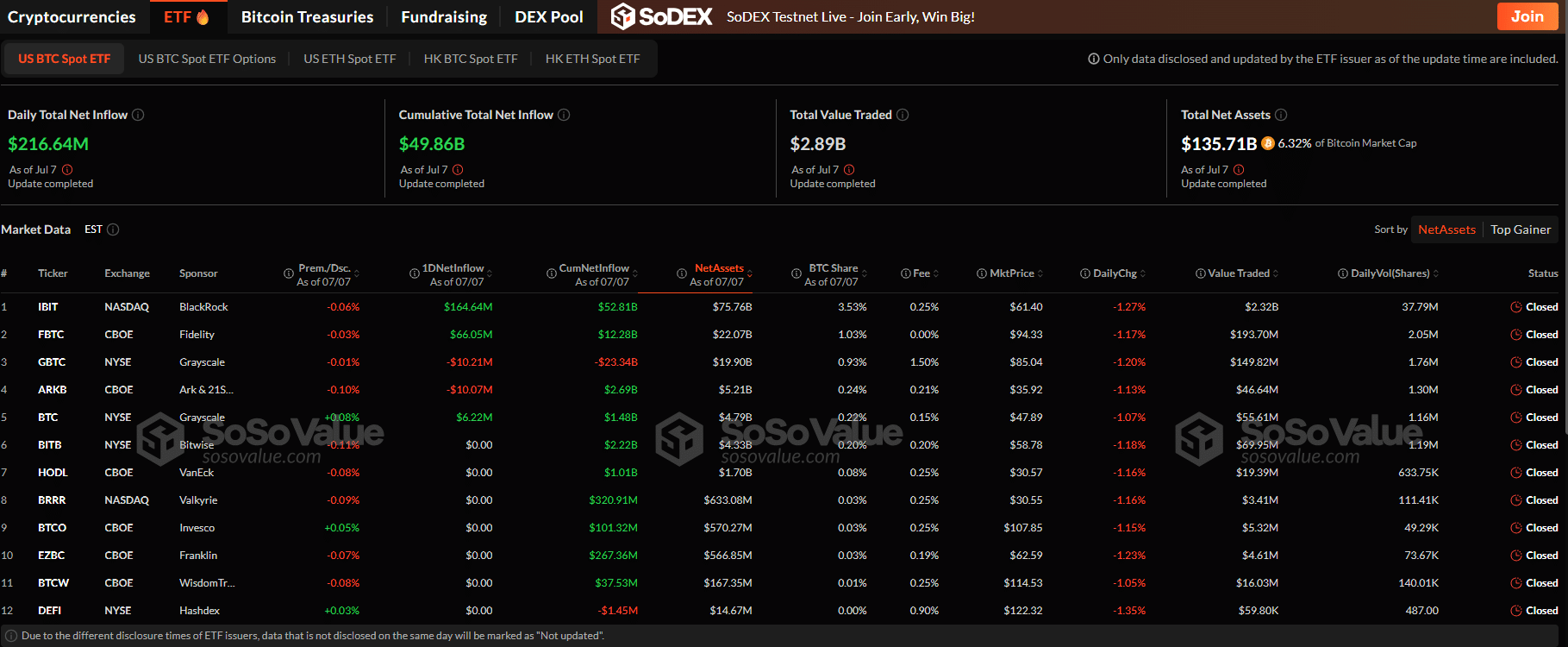

There’s presently 18.3 million ETH on exchanges, equal to fifteen.2% of the provision, barely above the 14.8% that’s staked.

The 18.3 million ETH on exchanges represents the bottom determine since June 2018, on the depths of the earlier crypto winter.

The chart reveals that the stability has been falling steadily since ETH staking got here on-line.

After all, the above charts are in native items. When flipping the denominated unit to the greenback worth of ETH as a substitute, you get a a lot wackier sample. Nonetheless, the greenback worth on exchanges continues to be above what it was till the primary quarter of 2021.

As cryptocurrency markets as a complete rally off the again of renewed hope that the Federal Reserve will pivot off excessive rate of interest coverage before beforehand anticipated, Ethereum has adopted, buying and selling at $1,800, its highest value since final September – proper when the Merge occurred.

Macro will proceed to drive the worth going ahead, however the Shanghai improve is nonetheless an vital second as Ethereum solidifies its lengthy strategy of switching from a proof-of-work blockchain to proof-of stake.